Articles | May 22, 2020 | 3 min read

Coronavirus Is Hurting the Automotive Industry Beyond Sales

Everyone knows coronavirus is hurting the automotive industry, especially when it comes to sales.

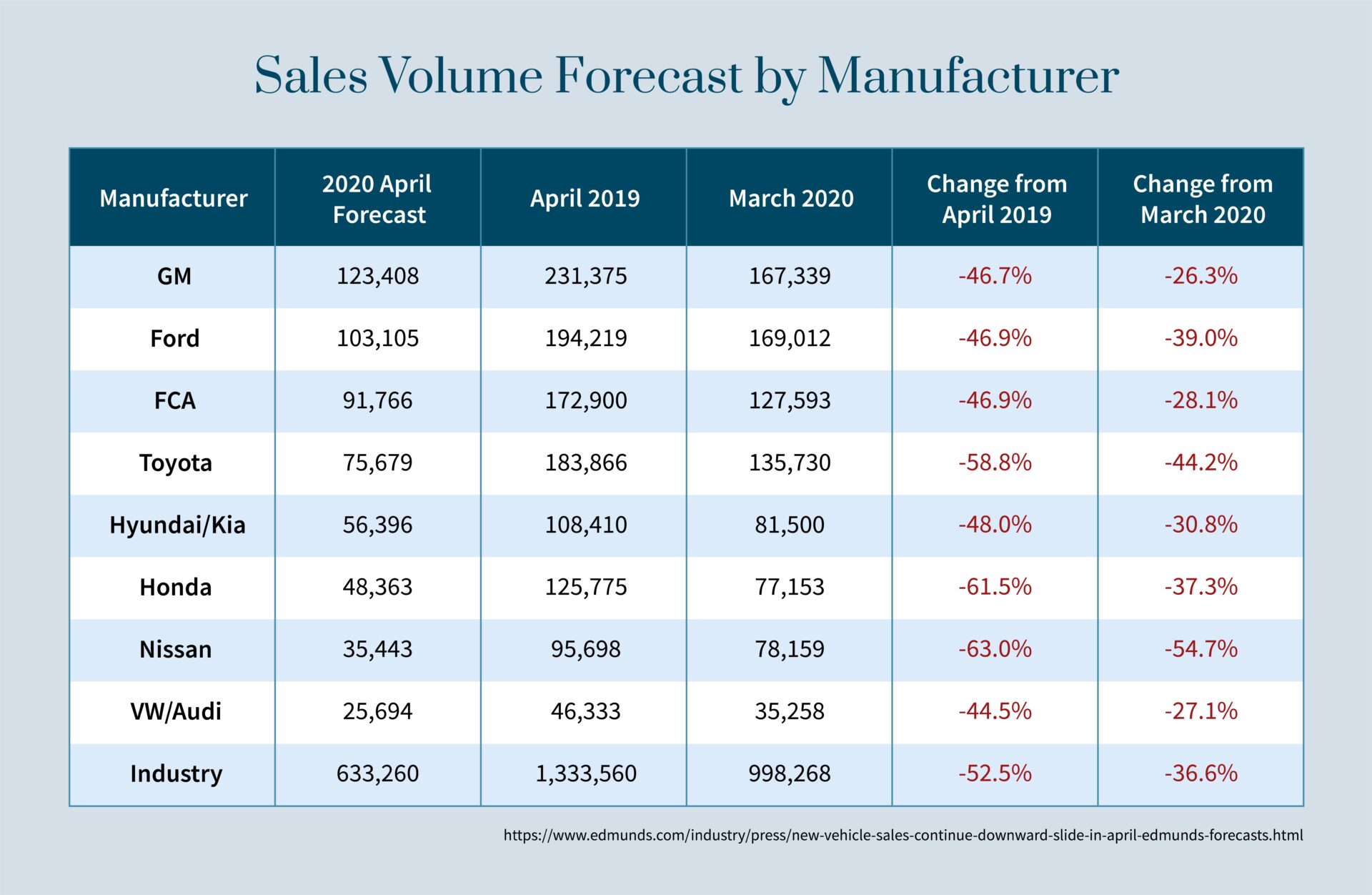

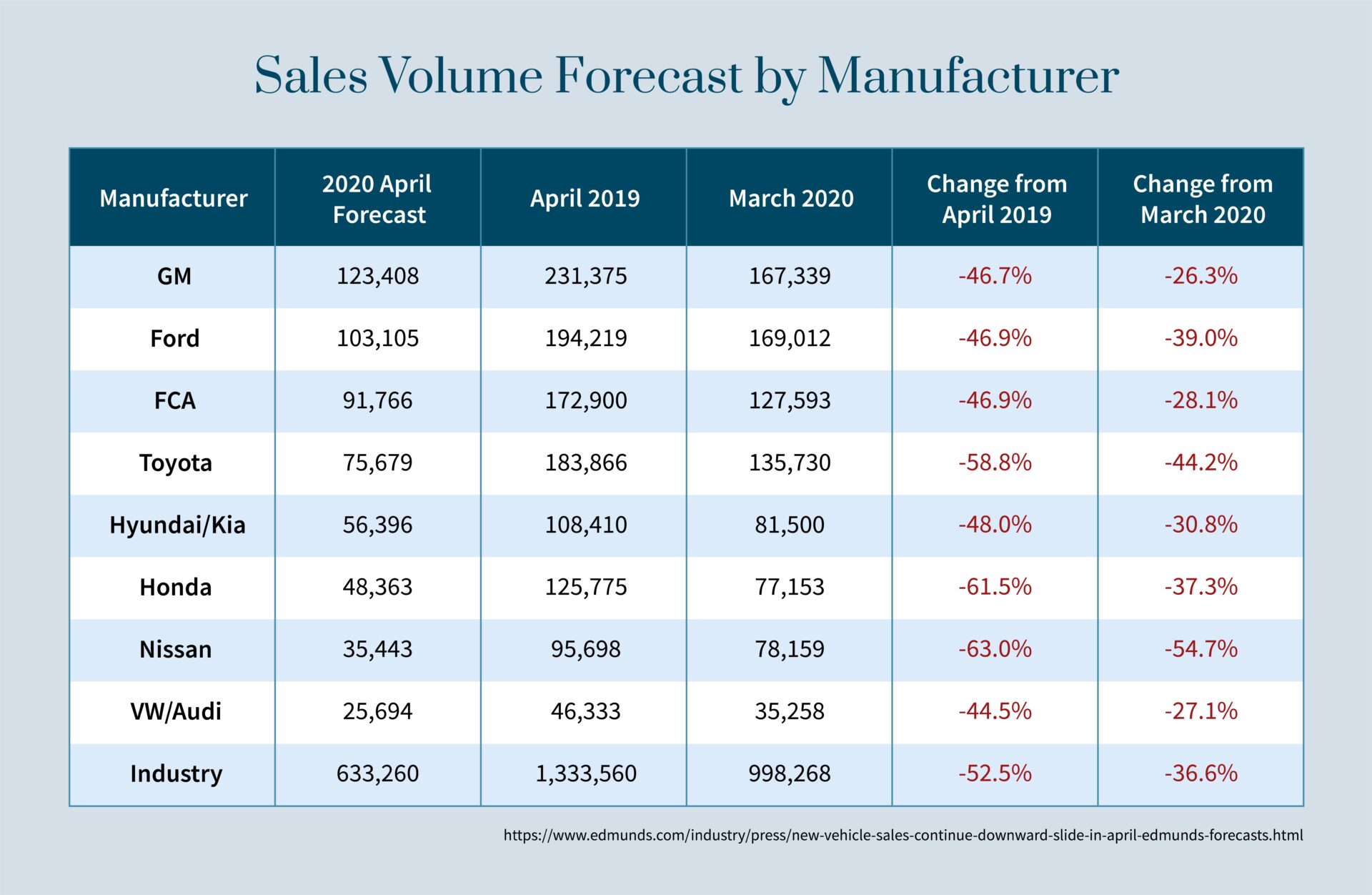

As an example, look at this year compared to April of 2019. In 2020, new vehicle sales are down by approximately 50%.

Thanks to an abysmal March and April, industry experts like J.D. Power are downgrading their projections for total U.S. new vehicle sales in 2020 by 33%, from 16.8 million new vehicles to 11.3 million.

But the impact of coronavirus goes beyond new vehicle sales.

Here are the other ways in which coronavirus is hurting the automotive industry…

Many of the world’s leading auto manufacturers, including Ford, General Motors, and Fiat Chrysler Automotive shut down their assembly lines in response to the coronavirus long-before state governments mandated they do so.

Is it a painful disruption for major carmakers?—Absolutely. But it’s a disruption they can survive.

The same can’t be said of the smaller, independent manufacturing organizations. The companies responsible for producing essential components like aluminum alloy wheels, mufflers, and brake pads.

Whereas large car manufacturers like Honda are “well-capitalized, the thousands of parts firms that feed the industry’s global supply chain operate…with less of a cash cushion and contract orders that need to be filled.”

Many of these smaller manufacturers laid off their entire labor force to endure the economic turmoil created by the coronavirus. Replacing those workers once social distancing measures are relaxed and resuming normal production won’t be easy.

Pressing pause on a carefully balanced supply chain is typically calamitous.

When a few big car makers shut down, hundreds of smaller, manufacturers, suppliers, and logistics providers shut down too. These smaller companies don’t have the capital nor the credit that large, name-brand carmakers have. This makes surviving an economic crisis like this recession more difficult.

(Remember that during the Great Recession there was a “wave of bankruptcies…that ultimately thinned out the number of auto-parts firms operating in the U.S.”).

If too many of these auxiliary businesses close their doors, it will make restarting the automotive supply chain more difficult.

As former Ford Chief Executive, Mark Fields, explained to The Wall Street Journal, paused production is “a problem for the supply base, which means it will be a problem for the [major carmakers].”

Considering the typical sedan has tens of thousands of parts, there are thousands upon thousands of ways to disrupt the supply chain. “A disruption at even one firm could have a cascading effect, ultimately having an impact on production at multiple assembly factories,” like the Volkswagen assembly plant in Chattanooga, Tennessee that employs 2,000 people.

Dealers are still selling cars, but replacement vehicles from OMEs aren’t getting to lots fast enough.

Without replacement vehicles to fill sold inventory, open dealers are finding themselves between a rock and hard place:

As automotive experts at J.D. Power explained to reporters at CNBC, “dealers are really starting to burn through their inventory they have on the ground…if U.S. vehicle production doesn’t restart [soon], the industry could [face] a new vehicle supply problem in certain markets and high-demand segments.”

Cratering used-car prices are a bad sign for the automotive industry.

The “Manheim Used Vehicle Value Index—a key benchmark for industry pricing—declined about 11%” in the month of April, and is down approximately 10% in 2020.

Falling prices have a number of ramifications for the automotive industry as a whole. Especially considering the used-market has a far larger supply of vehicles than the new-car market.

As used-car prices slip, it creates downward pressure on new-car prices. This forces manufacturers to make financial concessions that incentivize consumers to buy a new car instead of a used one.

Additionally, the in-house lending units of many automakers will have to write down the value of “contracts that had assumed vehicles would retain greater value.”Concessions and write downs hurt profitability, and lower profitability will extend the timetable for returning to pre-coronavirus earnings.

But it’s not just new-car makers that will feel the pain due to the used-car price depression. Large dealers like AutoNation and Sonic Automotive, rental companies like Hertz, financiers like Ally Financial, and auction providers like Copart will suffer too, as their operations rely heavily on revenue generated from the used-car market.

To learn more about the current state of the automotive industry, or to better understand how coronavirus is hurting the automotive industry, talk to Zeta.

As an example, look at this year compared to April of 2019. In 2020, new vehicle sales are down by approximately 50%.

Thanks to an abysmal March and April, industry experts like J.D. Power are downgrading their projections for total U.S. new vehicle sales in 2020 by 33%, from 16.8 million new vehicles to 11.3 million.

But the impact of coronavirus goes beyond new vehicle sales.

Here are the other ways in which coronavirus is hurting the automotive industry…

Coronavirus is killing the supply chain

Many of the world’s leading auto manufacturers, including Ford, General Motors, and Fiat Chrysler Automotive shut down their assembly lines in response to the coronavirus long-before state governments mandated they do so.

Is it a painful disruption for major carmakers?—Absolutely. But it’s a disruption they can survive.

The same can’t be said of the smaller, independent manufacturing organizations. The companies responsible for producing essential components like aluminum alloy wheels, mufflers, and brake pads.

Whereas large car manufacturers like Honda are “well-capitalized, the thousands of parts firms that feed the industry’s global supply chain operate…with less of a cash cushion and contract orders that need to be filled.”

Many of these smaller manufacturers laid off their entire labor force to endure the economic turmoil created by the coronavirus. Replacing those workers once social distancing measures are relaxed and resuming normal production won’t be easy.

It’s hard to press “pause” on an industry with 10 million employees

Pressing pause on a carefully balanced supply chain is typically calamitous.

When a few big car makers shut down, hundreds of smaller, manufacturers, suppliers, and logistics providers shut down too. These smaller companies don’t have the capital nor the credit that large, name-brand carmakers have. This makes surviving an economic crisis like this recession more difficult.

(Remember that during the Great Recession there was a “wave of bankruptcies…that ultimately thinned out the number of auto-parts firms operating in the U.S.”).

If too many of these auxiliary businesses close their doors, it will make restarting the automotive supply chain more difficult.

As former Ford Chief Executive, Mark Fields, explained to The Wall Street Journal, paused production is “a problem for the supply base, which means it will be a problem for the [major carmakers].”

Considering the typical sedan has tens of thousands of parts, there are thousands upon thousands of ways to disrupt the supply chain. “A disruption at even one firm could have a cascading effect, ultimately having an impact on production at multiple assembly factories,” like the Volkswagen assembly plant in Chattanooga, Tennessee that employs 2,000 people.

COVID-19 is creating inventory issues at car dealerships

Dealers are still selling cars, but replacement vehicles from OMEs aren’t getting to lots fast enough.

Without replacement vehicles to fill sold inventory, open dealers are finding themselves between a rock and hard place:

- Stay open, and risk running out of the vehicles consumer’s are most interested in. Thus hurting brand recognition in the community and possibly jeopardizing future sales.

- Or close of the time being, preserve existing inventory, and wait for the supply chain to reactivate.

As automotive experts at J.D. Power explained to reporters at CNBC, “dealers are really starting to burn through their inventory they have on the ground…if U.S. vehicle production doesn’t restart [soon], the industry could [face] a new vehicle supply problem in certain markets and high-demand segments.”

If things are bad for new car sales, they’re worse for used cars

Cratering used-car prices are a bad sign for the automotive industry.

The “Manheim Used Vehicle Value Index—a key benchmark for industry pricing—declined about 11%” in the month of April, and is down approximately 10% in 2020.

Falling prices have a number of ramifications for the automotive industry as a whole. Especially considering the used-market has a far larger supply of vehicles than the new-car market.

As used-car prices slip, it creates downward pressure on new-car prices. This forces manufacturers to make financial concessions that incentivize consumers to buy a new car instead of a used one.

Additionally, the in-house lending units of many automakers will have to write down the value of “contracts that had assumed vehicles would retain greater value.”Concessions and write downs hurt profitability, and lower profitability will extend the timetable for returning to pre-coronavirus earnings.

But it’s not just new-car makers that will feel the pain due to the used-car price depression. Large dealers like AutoNation and Sonic Automotive, rental companies like Hertz, financiers like Ally Financial, and auction providers like Copart will suffer too, as their operations rely heavily on revenue generated from the used-car market.

Looking to learn more about how coronavirus is hurting the automotive industry?

To learn more about the current state of the automotive industry, or to better understand how coronavirus is hurting the automotive industry, talk to Zeta.