Articles | April 15, 2020 | 3 min read

Internet Traffic Trends for the Week of April 13th, 2020

Trending Up…

- Sugar-based Snacks

- Luxury Brand Hotels

- US Auto Manufacturers

Trending Down…

- Malls

- Airports

- Gyms

Hospitality

The coronavirus hit Hospitality harder than most industries, but better days appear to be on the horizon, with luxury hotel brands showing indications of recovery. While time on site remains low across the board for the hotel industry (slipping further for economy brands than luxury brands), bookings are increasing—a signal that focused, decisive travelers are expecting a return to normal travel in the coming weeks.

Week over week, Zeta has seen a…

- 22% INCREASE in traffic to luxury brand hotel sites.

- 11% DECREASE in time on site for all hotel sites.

Sugar-Based Snacks

Consumer interest in sugar-based snacks (candy, chocolate, cookies, etc.) and sweeteners has spiked in the past week, piggy-backing off last week’s interest spike in cooking and baking.

Week over week, Zeta has seen a…

- 15% INCREASE in content related to candy, chocolate, and cookies.

Automotive

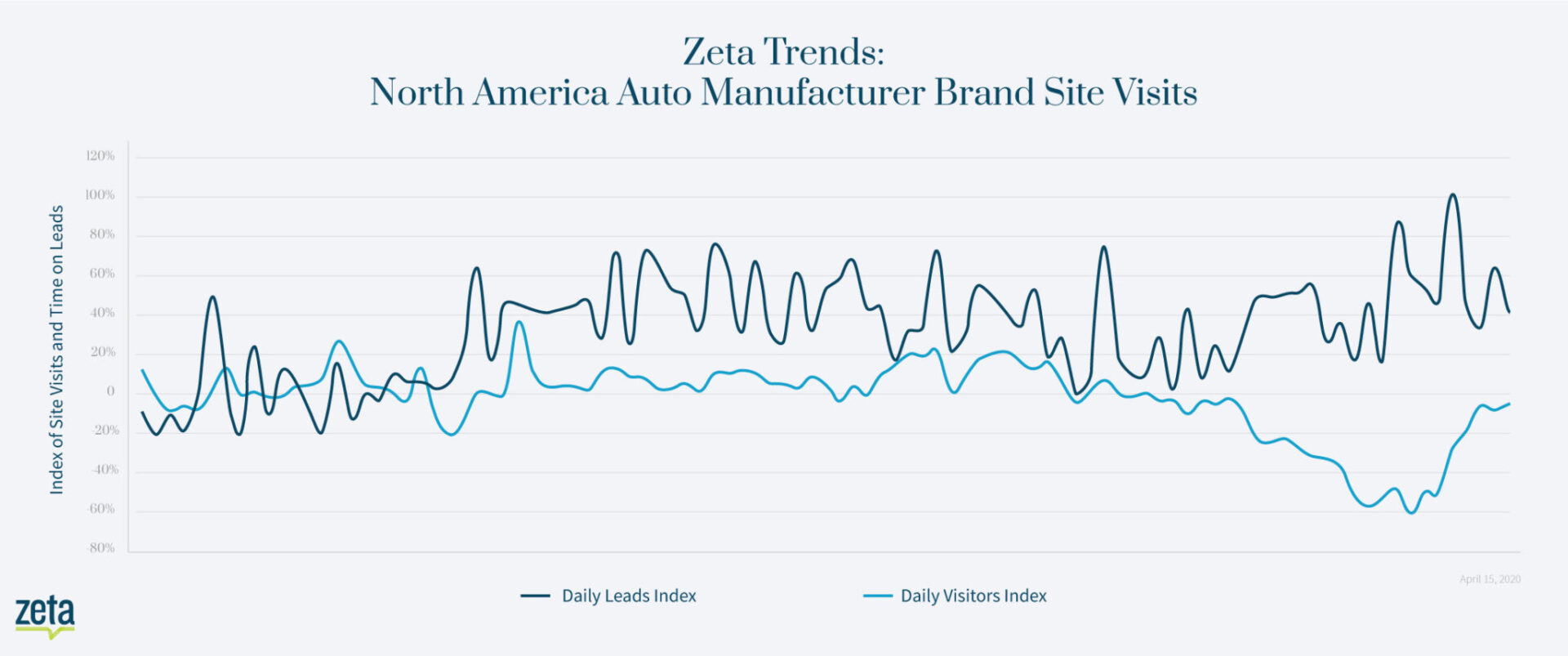

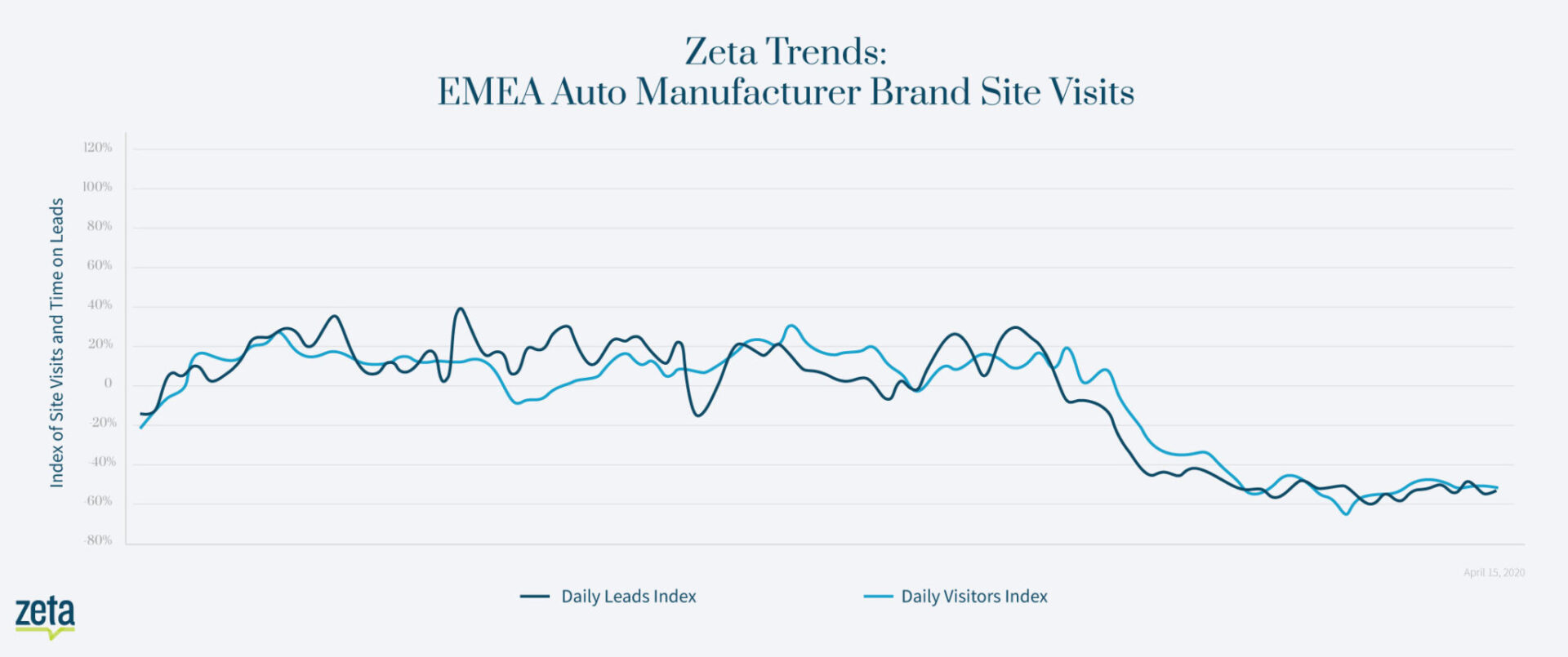

Domestic automotive website traffic has seen tremendous week-over-week growth, whereas traffic to European automotive sites remains flat. In all likelihood, this disparity has something to do with increased access to credit in the United States and strong incentivization programs from manufacturers.

Additionally, traffic to auto-supply stores is up week-over-week, suggesting that consumers are using the downtime tied to COVID-19 to address overdue maintenance.

Week over week, Zeta has seen a…

- 49% INCREASE in traffic to US auto-manufacturer websites.

- 2% INCREASE in visits to US auto parts supply stores.

Physical Visitation

While social distancing mandates continue to minimize foot traffic to brick-and-mortar across the country, some businesses (e.g. grocery stores, banks, and quick-serve restaurants) are faring much better than others (e.g. gyms, airports, malls, and liquor stores). Malls have been especially hard hit, and are seeing record declines in foot traffic given the expanded shelter-in-place orders.

Week over week, Zeta has seen a…

- 2% DECREASE in visits to liquor stores.

- 3% DECREASE in visits to grocery stores.

- 5% DECREASE in visits to quick-serve restaurants.

- 7% DECREASE in visits to banks.

- 13% DECREASE in visits to gyms.

- 29% DECREASE in visits to airports.

- 70% DECREASE in visits to malls.

Display

Within display, CPMs are beginning to bifurcate. Despite the increase in overall inventory supply (driven by more in-home browsing) some verticals are seeing an increase in CPMs (e.g. gaming, healthcare, and quick-serve restaurants), while others are seeing declining CPMs (e.g. travel, hospitality, and brick-and-mortar retail).

Week over week, Zeta has seen a…

- 12% to 19% INCREASE in CPM for gaming, healthcare, and quick-serve restaurants.

- 28% to 40% DECREASE in CPM for travel, hospitality, and brick-and-mortar retail.

Video

Marketers seem to be pivoting back towards digital video after hesitating to spend for several weeks, with the greatest spend increases coming in healthcare, auto supply, and quick-serve restaurants.

Week over week, Zeta has seen a…

- 14% INCREASE in video-related CPMs across all verticals.

- 17% INCREASE in video-related CPMs across healthcare, auto supply and quick-serve restaurants verticals.

Zeta’s Big Takeaway

While the global economy has slowed due to the coronavirus pandemic, governments appear to be getting a gradual handle on the outbreak. Although we’re still several weeks away from shelter-in-place and social-distancing mandates being lifted, consumers are starting to see glimpses of the light at the end of the tunnel. This hypothesis is reinforced (albeit not proven) by the upswing in interest for hospitality and automotive content.

In continuing to navigate the turbulent economic climate, it will be imperative for your brand to:

- Embrace new ad technologies that allow for more effective audience segmentation and engagement.

- Persevere with awareness initiatives so consumers don’t lose sight of how your brand can meet their needs.

- Capitalize on opportunities to gain mindshare and market share (in other words, when competitors throttle back on advertising, your business should throttle up).

Zeta Global hopes the following insights can help guide you to make wiser decisions over the weeks and months ahead. In the meantime, stay safe, stay healthy, and be well.