Articles | November 9, 2020 | 2 min read

Projections Retailers Need to Know for Black Friday and Cyber Monday

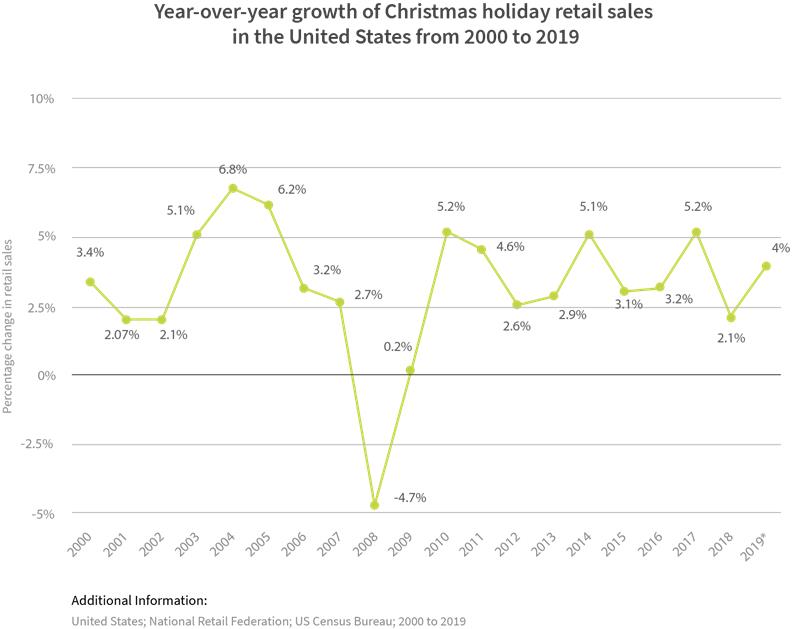

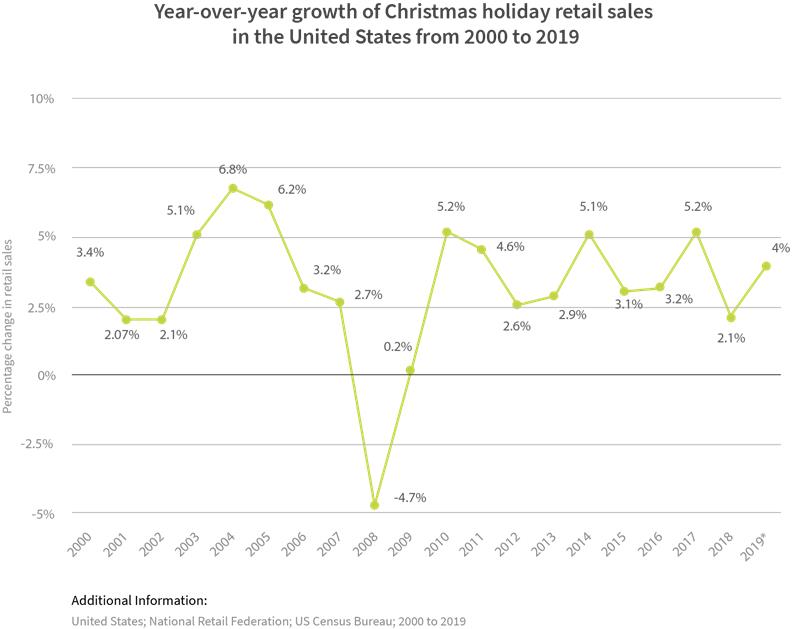

Holiday retail sales have grown by an average of 3.25% year over year (YoY) for the last 20 years. In fact, the only year in the last two decades where holiday retail sales didn’t increase YoY was 2008—the year of the Great Recession (that year, holiday retail sales declined by 4.7%). Although 2020 shouldn’t be as poor as 2008, the economic consequences of COVID-19 make it unlikely that year-over-year sales will match the 3.25% average growth rate set during the previous 20 years.

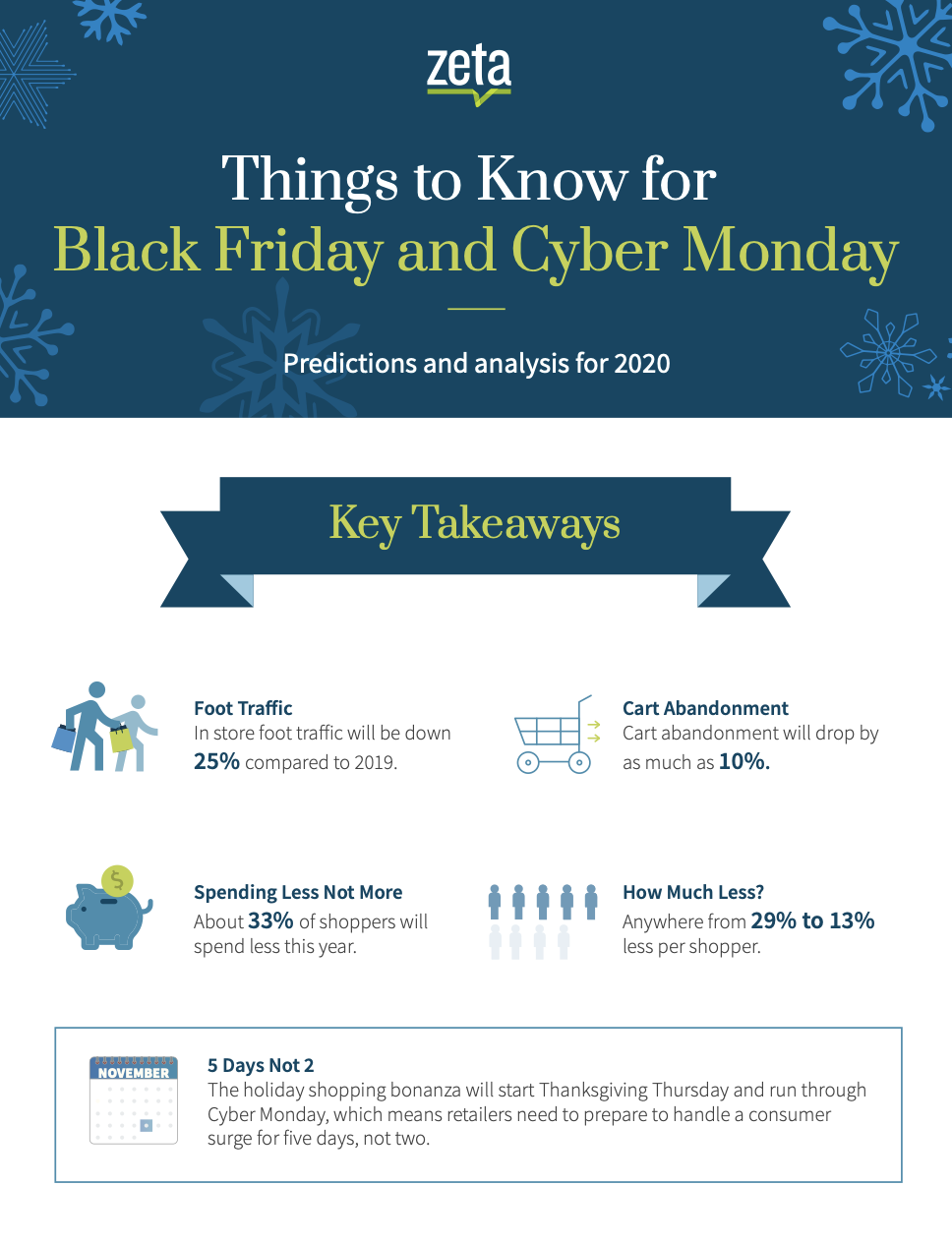

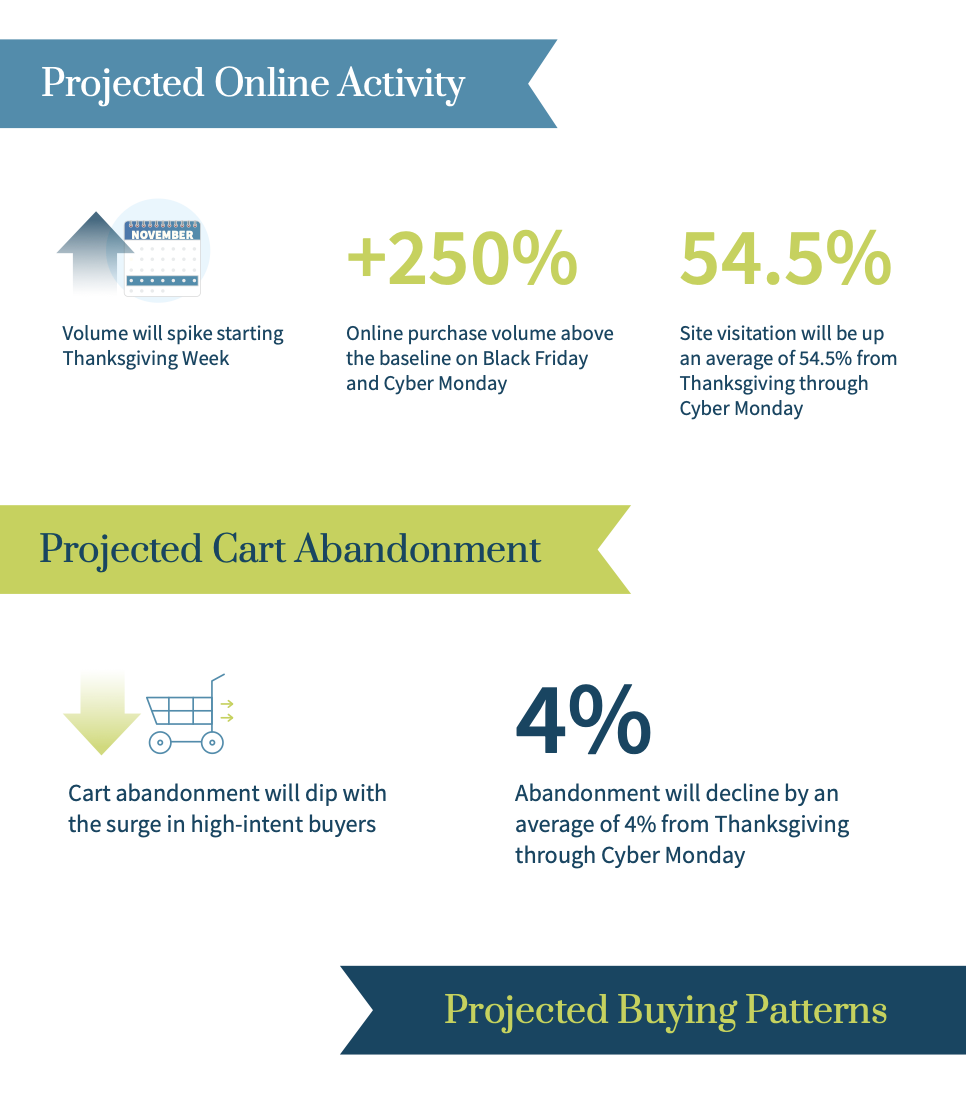

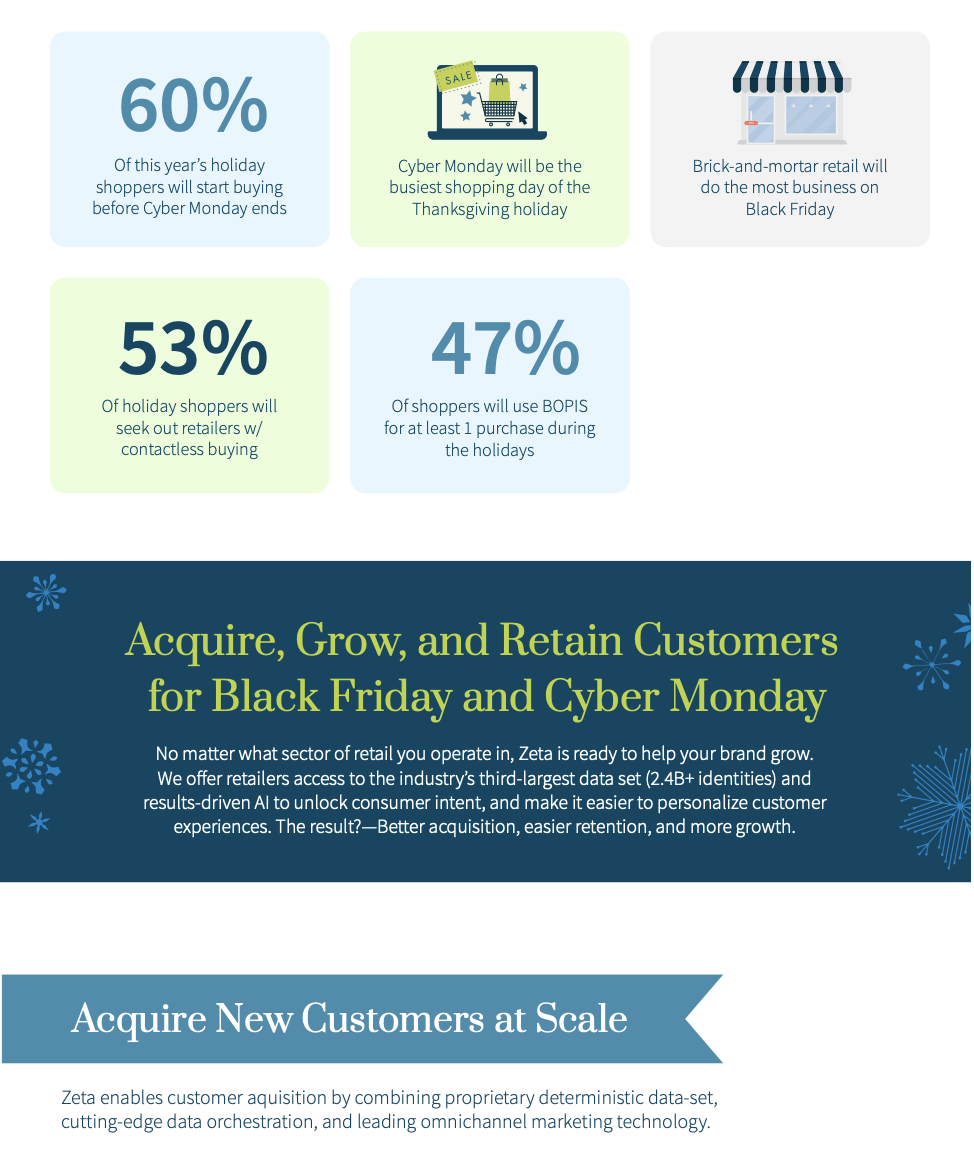

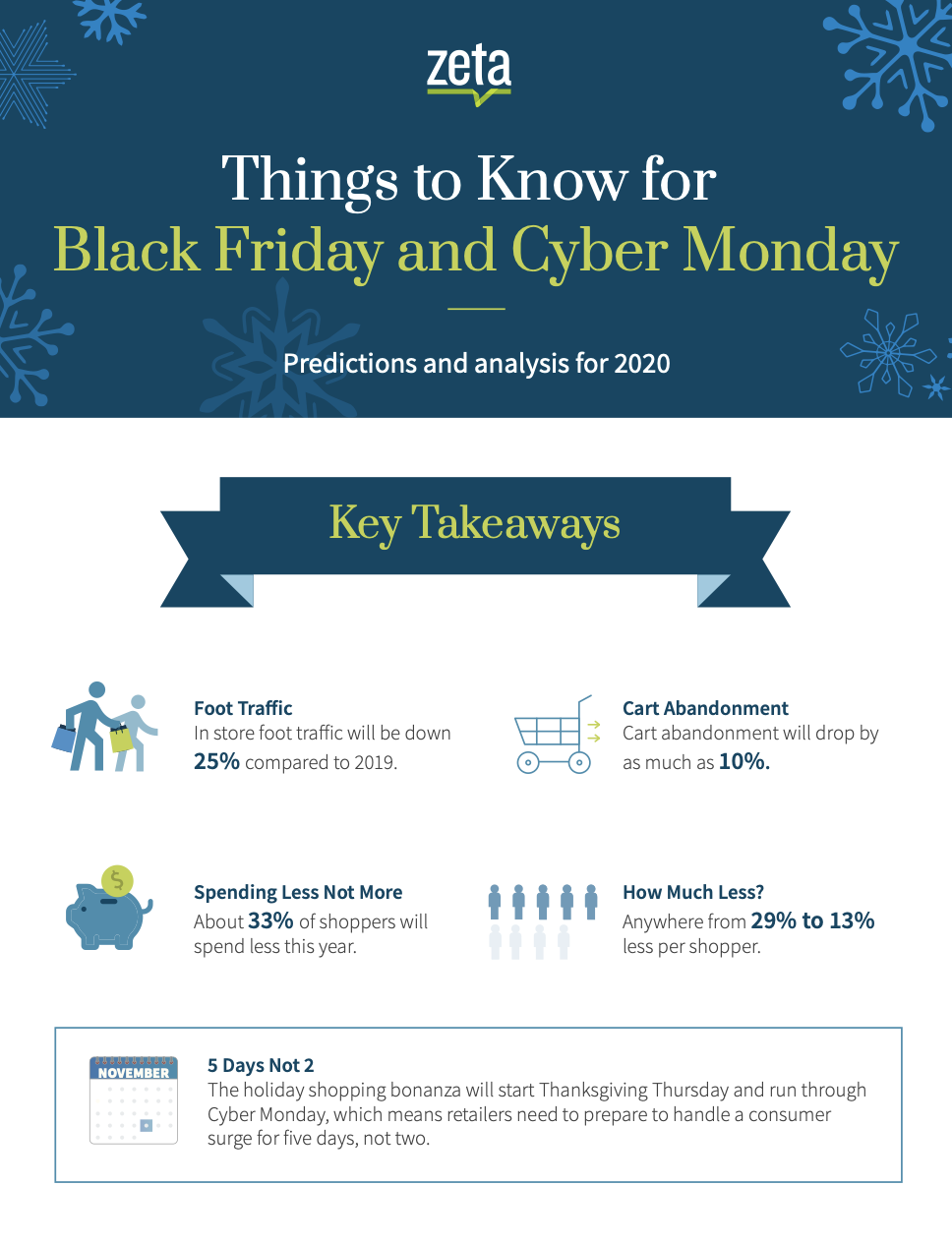

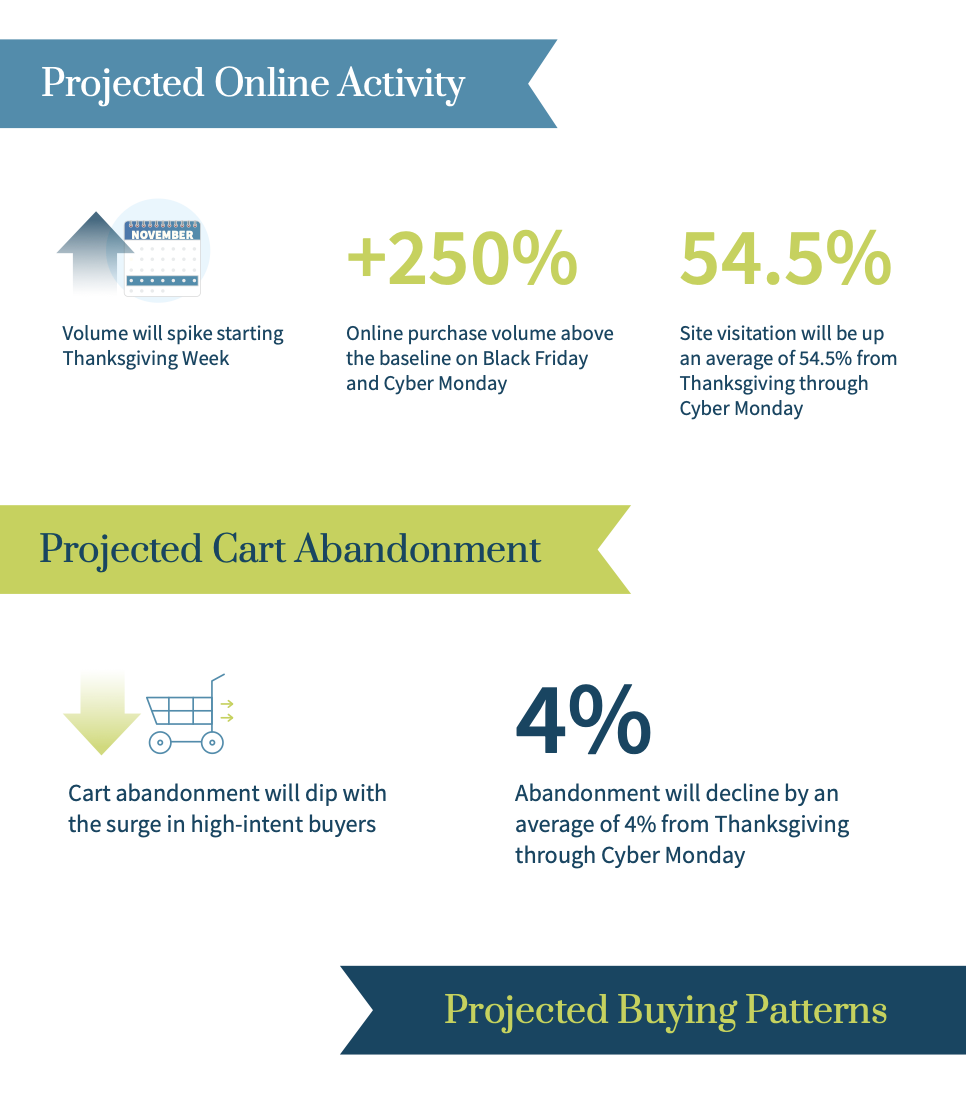

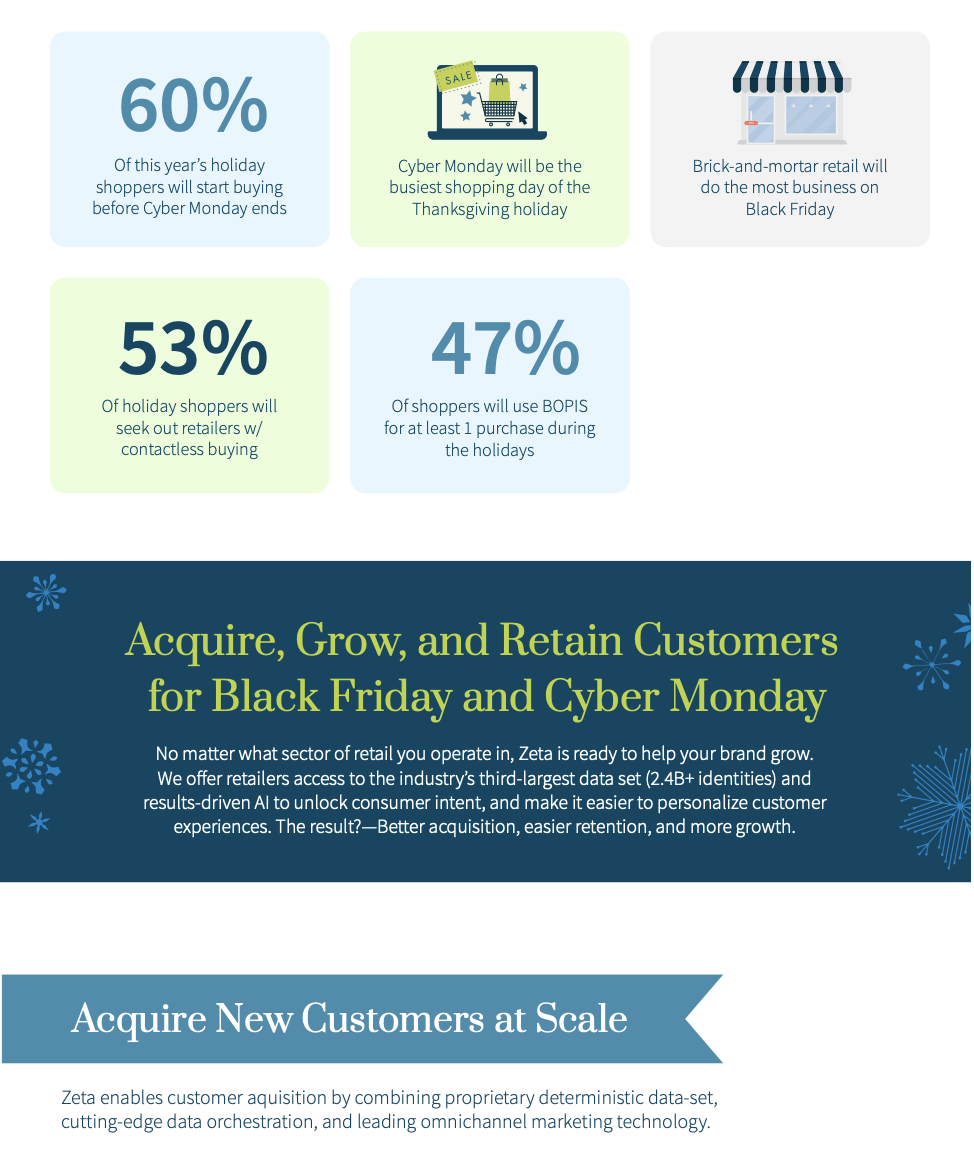

Retailers should expect this year’s Black Friday and Cyber Monday to be the most competitive in the last decade. In addition to there being fewer consumers willing to spend, Zeta’s data shows those consumers who do engage in shopping during Black Friday and Cyber Monday will be more dollar-conscious than in years past. That means retailers will not only be competing for the same lower number of shoppers, but they’ll be competing for fewer discretionary dollars per shopper as well.

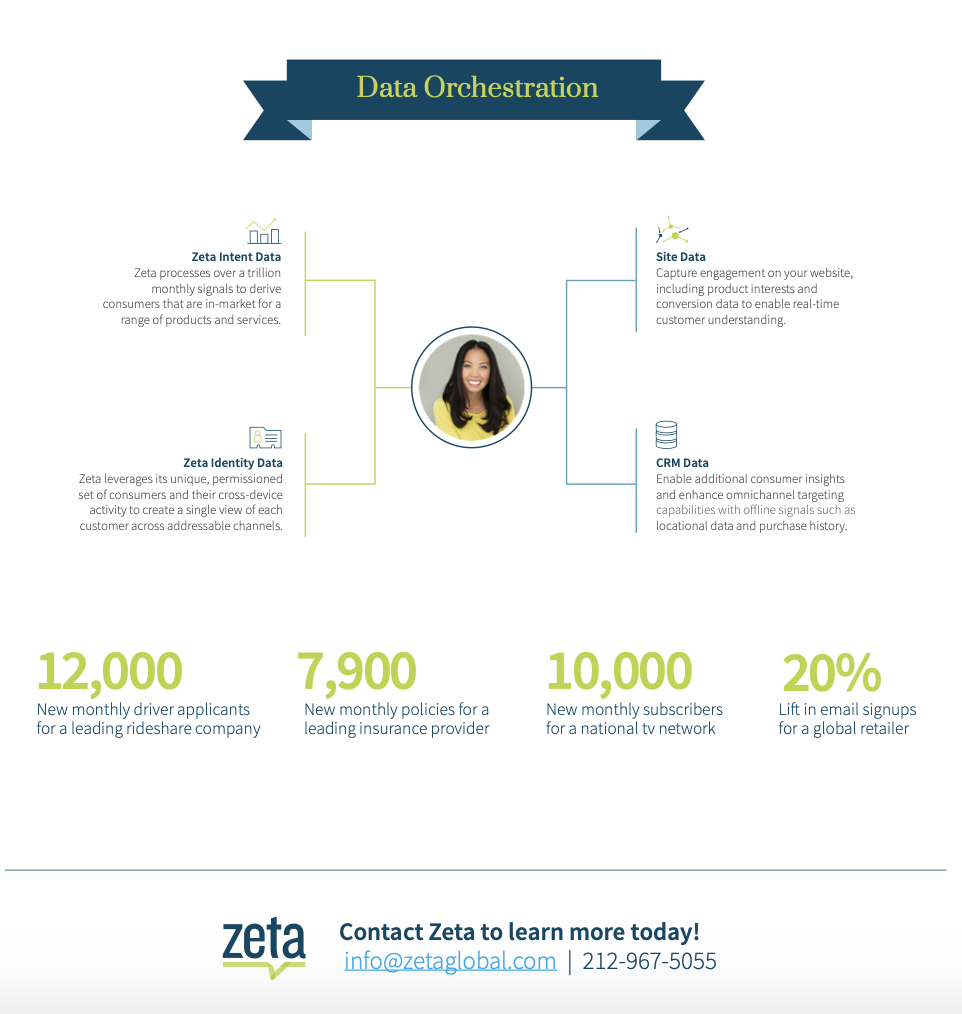

To secure as big a slice of the holiday-retail pie as possible, brands must use data to:

In an effort to help brands get a competitive advantage heading into Black Friday and Cyber Monday, Zeta created the following infographic layered with helpful predictions based on what we’ve seen from consumers thus far in 2020, as well as what we’ve seen from consumers during previous Black Fridays and Cyber Mondays.

Retailers should expect this year’s Black Friday and Cyber Monday to be the most competitive in the last decade. In addition to there being fewer consumers willing to spend, Zeta’s data shows those consumers who do engage in shopping during Black Friday and Cyber Monday will be more dollar-conscious than in years past. That means retailers will not only be competing for the same lower number of shoppers, but they’ll be competing for fewer discretionary dollars per shopper as well.

To secure as big a slice of the holiday-retail pie as possible, brands must use data to:

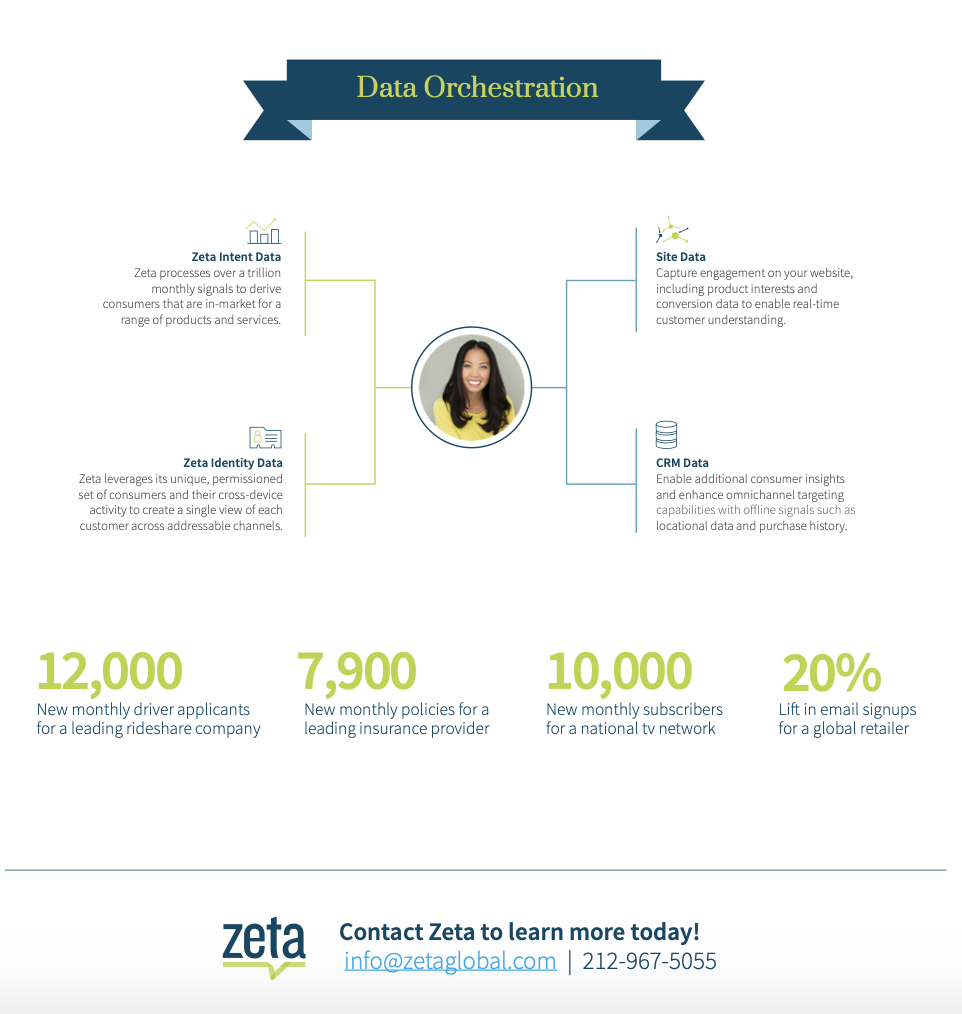

- Obtain a clear picture of who the customer is at a 1:1 level

- Ensure all marketing and messaging is timely, personal, relevant, and consistent across all channels

In an effort to help brands get a competitive advantage heading into Black Friday and Cyber Monday, Zeta created the following infographic layered with helpful predictions based on what we’ve seen from consumers thus far in 2020, as well as what we’ve seen from consumers during previous Black Fridays and Cyber Mondays.