Articles | June 22, 2020 | 3 min read

What History Says About Cutting Marketing Spend in a Recession

When the economy hits a brick wall, most brands look to cut one thing above all—the marketing budget. But based on available evidence, cutting marketing spend in a recession doesn’t make sense.

In fact, data shows that companies who stay the course with their marketing (i.e. the maintain spend as well as relevant, ROI-positive campaigns) see compelling returns when the economy recovers. Chiefly, these brands see expanded market share and improved long-term profitability.

According to the National Bureau of Economic Research, the last four American recessions occurred at roughly 10-year intervals:

In each of these recessions, the businesses that maintained (or expanded) their engagement with marketing and advertising enjoyed a windfall.

During the recession of 1981 to 1982, the businesses that maintained or increased their spend grew by 275% over those that cut back.

During the recession of 1991, the businesses that found a way to maintain or increase their marketing budget saw as much as a 70% increase in sales by the time the recession ended.

When the dot-com bubble burst in 2001, sending the economy into a tailspin, the companies that sustained their marketing efforts generated 2.5X more sales than those brands that cut back to save cash.

And during the Great Recession of 2007 to 2009? The worst economic crisis to befall the American people since the Great Depression when the marketing and advertising industry saw a gargantuan 13% drop in spending nationwide? Well, the research suggests the brands that managed to keep spending on marketing and advertising consistently achieved higher net profits.

History says cutting marketing spend in a recession isn’t a smart move—but that’s during a normal recession.

This recession is different.

The economy isn’t hurting because of a man-made disaster—there’s no housing bubble, internet bubble, or oil crisis. The economy is hurting because of an unexpected and unpredictable force of nature—a global pandemic triggered by a novel coronavirus.

Stock markets, job markets, and every other kind of market went from rip-roaring to sputtering overnight. The economy, both at home and abroad, is limping under the weight of government-mandated shutdowns, supply-chain disruptions, historic unemployment, and the rapidly changing expectations of the distance-conscious consumer.

Just how long this recession will last remains unknown, but what is known is that it will likely linger through Q3 2020. Concerns surrounding the coronavirus, the lack of a vaccine, and the inherent economic burden created by social distancing blended with massive unemployment mean consumers will be slow to resume their pre-COVID-19 spending habits.

Specifically, consumers will be hesitant to do things like travel, dine-out, and visit brick-and-mortar businesses.

However, none of this means brands should press pause on their marketing.

If history is any indicator, cutting marketing spend in a recession is a very bad idea. If brands are going to do anything, they should consider reallocating funds away from traditional marketing (e.g. billboards, flyers, mailers, etc.) and put those funds into digital.

Why digital? Because digital always delivers more during a recession. More accuracy, more transparency, more ROI…more everything. That’s why digital marketing blew traditional marketing out of the water during the Great Recession…

And it’s why digital marketing will win again in this recession.

In fact, data shows that companies who stay the course with their marketing (i.e. the maintain spend as well as relevant, ROI-positive campaigns) see compelling returns when the economy recovers. Chiefly, these brands see expanded market share and improved long-term profitability.

Recession history: Not cutting marketing spend creates better outcomes

According to the National Bureau of Economic Research, the last four American recessions occurred at roughly 10-year intervals:

- July 1981 to November 1982

- July 1991 to March 1991

- March 2001 to November 2001

- December 2007 to June 2009

In each of these recessions, the businesses that maintained (or expanded) their engagement with marketing and advertising enjoyed a windfall.

During the recession of 1981 to 1982, the businesses that maintained or increased their spend grew by 275% over those that cut back.

During the recession of 1991, the businesses that found a way to maintain or increase their marketing budget saw as much as a 70% increase in sales by the time the recession ended.

When the dot-com bubble burst in 2001, sending the economy into a tailspin, the companies that sustained their marketing efforts generated 2.5X more sales than those brands that cut back to save cash.

And during the Great Recession of 2007 to 2009? The worst economic crisis to befall the American people since the Great Depression when the marketing and advertising industry saw a gargantuan 13% drop in spending nationwide? Well, the research suggests the brands that managed to keep spending on marketing and advertising consistently achieved higher net profits.

What makes this recession tricky?

History says cutting marketing spend in a recession isn’t a smart move—but that’s during a normal recession.

This recession is different.

The economy isn’t hurting because of a man-made disaster—there’s no housing bubble, internet bubble, or oil crisis. The economy is hurting because of an unexpected and unpredictable force of nature—a global pandemic triggered by a novel coronavirus.

Stock markets, job markets, and every other kind of market went from rip-roaring to sputtering overnight. The economy, both at home and abroad, is limping under the weight of government-mandated shutdowns, supply-chain disruptions, historic unemployment, and the rapidly changing expectations of the distance-conscious consumer.

So…what should brands do?

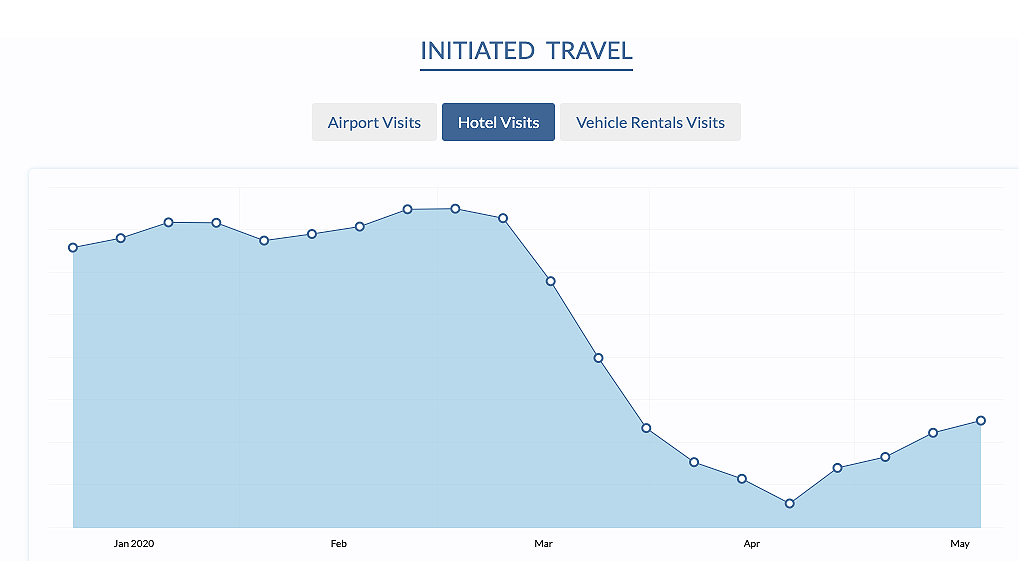

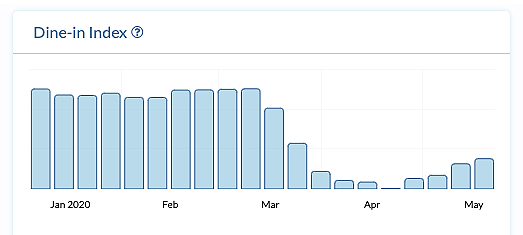

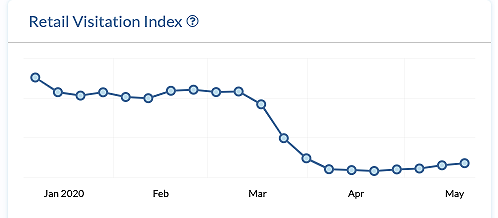

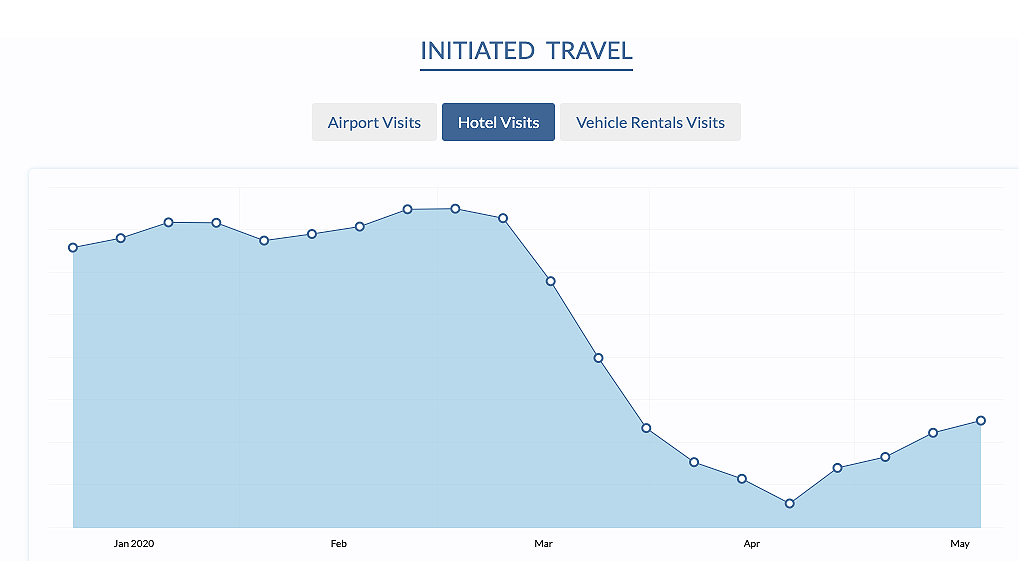

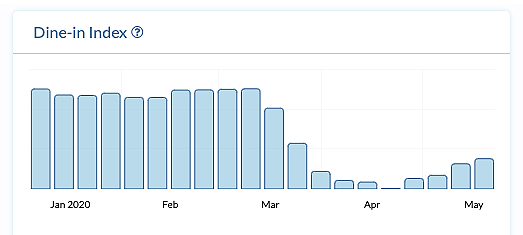

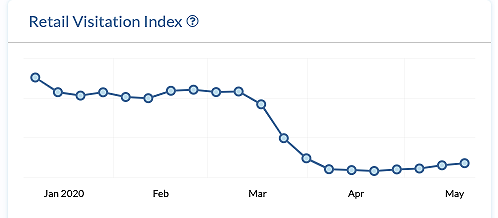

Just how long this recession will last remains unknown, but what is known is that it will likely linger through Q3 2020. Concerns surrounding the coronavirus, the lack of a vaccine, and the inherent economic burden created by social distancing blended with massive unemployment mean consumers will be slow to resume their pre-COVID-19 spending habits.

Specifically, consumers will be hesitant to do things like travel, dine-out, and visit brick-and-mortar businesses.

However, none of this means brands should press pause on their marketing.

If history is any indicator, cutting marketing spend in a recession is a very bad idea. If brands are going to do anything, they should consider reallocating funds away from traditional marketing (e.g. billboards, flyers, mailers, etc.) and put those funds into digital.

Why digital? Because digital always delivers more during a recession. More accuracy, more transparency, more ROI…more everything. That’s why digital marketing blew traditional marketing out of the water during the Great Recession…

And it’s why digital marketing will win again in this recession.