Articles | April 22, 2020 | 4 min read

Zeta Digital Trends – Week of April 20, 2020

Digital Trends on the Up…

- US Auto Manufacturers

- EMEA Auto Manufacturers

- Economy Brand Hotels

Digital Trends on the Decline…

- Video CPMs

- Display CPMs

Hospitality

The Hospitality industry is finally at its bottom, with site-visitor numbers holding steady week over week.

Meanwhile, time on site for economy brands has increased since last week, a reflection of consumers’ anticipation of a return to discretionary travel in the coming weeks.

Week over week, Zeta has seen a…

- ≈0% GROWTH in site visitors across all hotel sites.

- 13% INCREASE in time-spent on site for economy hotel brands.

Gaming, Gardening, and Sweets

Consumption of content related to sugar-based snacks (candy, chocolate, cookies, etc.) and sweeteners increased from last week, an indication that consumer interest in things like cooking, baking, and confectionaries remains high.

Sony PlayStation’s announcements regarding the PlayStation 5, and the Play At Home campaign, led to an unsurprising uptick in traffic related to gaming.

Similarly, the impending arrival of Earth Day, coupled with the warming spring weather, has rekindled consumers’ annual interest in gardening. In an attempt to cut down on grocery store visits in the coming months, people appear especially interested in content related to growing fruits and vegetables at home.

Week over week, Zeta has seen a…

- 19% INCREASE in content related to candy, chocolate, and cookies.

- 7% INCREASE in content related to Sony Playstation.

- 4% INCREASE in content related to gardening.

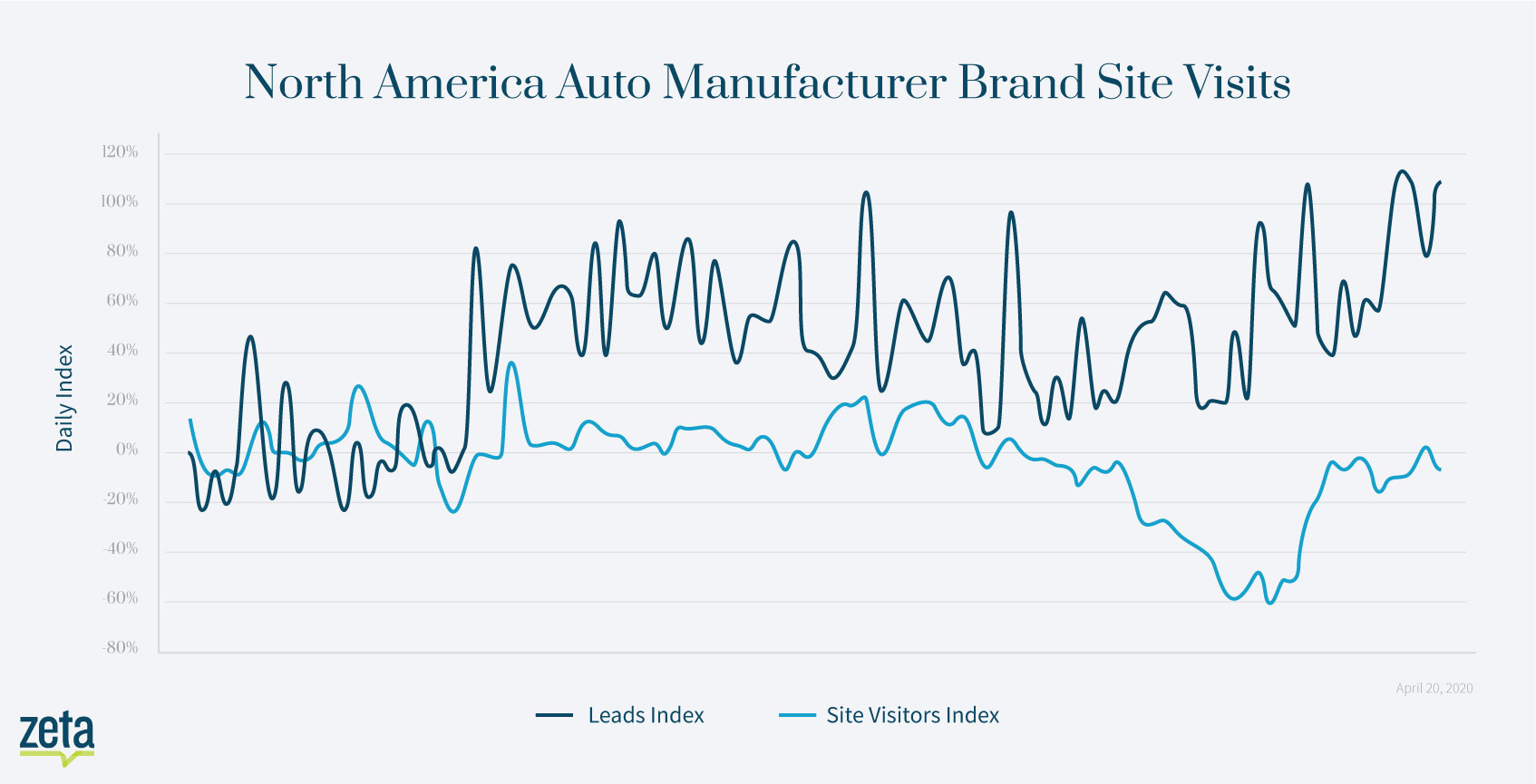

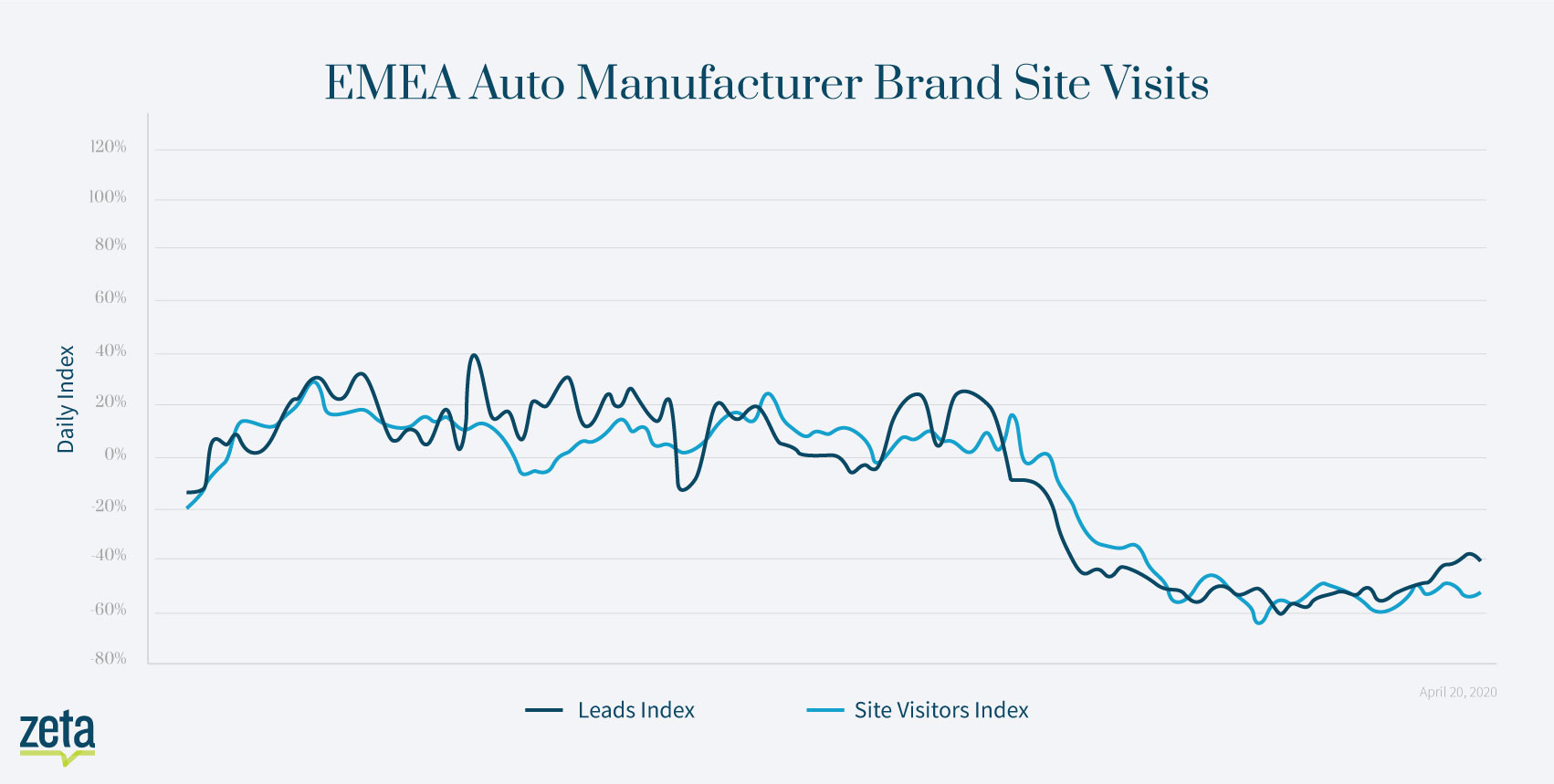

Automotive

US automotive website traffic continues its week-over-week upswing, with lead growth outpacing site visitor growth—a strong signal of consumer purchase intent.

In Europe, automotive sites are also seeing signs of recovery, though the signs aren’t as strong as in the US (a disparity explained by American manufacturers’ aggressive financial incentivization programs).

Additionally, traffic to auto-supply stores is up week-over-week, suggesting that consumers are using the downtime tied to COVID-19 to address overdue maintenance.

Week over week, Zeta has seen a…

- 17% INCREASE in leads from US auto-manufacturer websites.

- 31% INCREASE in leads from EMEA auto-manufacturer websites.

Physical Visitation

For physical visitation, most categories are flat week-over-week—a signal the brick-and-mortar economy is at its bottom. If physical-distancing mandates begin to lift in the coming weeks, expect to see foot traffic to brick-and-mortar businesses skyrocket, yet remain far short of where it was pre-COVID-19.

Week over week, Zeta has seen a…

- 2% INCREASE in visits to liquor stores.

- 5% DECREASE in visits to grocery stores.

- 2% DECREASE in visits to quick-serve restaurants.

Display

Display has dropped roughly ⅓ from prior Q1 levels. Week over week, display CPMs are generally flat, showing only a 1% decline. Verticals showing higher foot traffic are also showing week-over-week increases in CPMs. This suggests that marketers are beginning to reinvest in advertising for the goods and services consumers can still purchase while sheltering-in-place.

Week over week, Zeta has seen a…

- 1% DECREASE in display-related CPMs across all verticals

- 6% DECREASE in CPM for telecommunications

- 7% DECREASE in CPM for healthcare and quick-service restaurants

Video

Video CPMs are lower week-over-week, suggesting increased in-home video entertainment is generating more supply than demand.

Week over week, Zeta has seen a…

- 2% DECREASE in video CPMs for the education vertical.

- 4% DECREASE in video CPMs for quick-service restaurants

Zeta’s Big Digital Trends Takeaway

After enduring 4+ weeks of shelter-in-place mandates, consumers have adapted to their new normal—the initial surge towards things like grocery stores and away from things like hospitality has passed.

To fill their time at home, people are doing more than binge watching Netflix—they’re looking optimistically towards the future by researching cars to buy, gardens to start, and vacations to plan.

These signals buoy last week’s primary takeaway:

“Although we’re still several weeks away from shelter-in-place and social-distancing mandates being lifted, consumers are starting to see glimpses of the light at the end of the tunnel.”

In the coming weeks, brands should look to:

- Start production and publication of content that speaks to a return to life without shelter-in-place mandates.

- Capitalize on previously overlooked or underutilized marketing opportunities—channels like ConnectedTV or email.

- Slowly but surely turn the advertising spigot back on, with honest messaging that reflects a gradual return to normalcy.

Zeta hopes the following digital trends can help guide you to make wiser decisions over the weeks and months ahead. In the meantime, stay safe, stay healthy, and be well.