Articles | May 14, 2020 | 3 min read

Zeta Digital Trends – Week of May 11th, 2020

Digital Trends on the Up…

- Out-of-Home Shopping

- Automotive

- Hospitality

Digital Trends on the Decline…

- Video CPMs

- Display CPMs

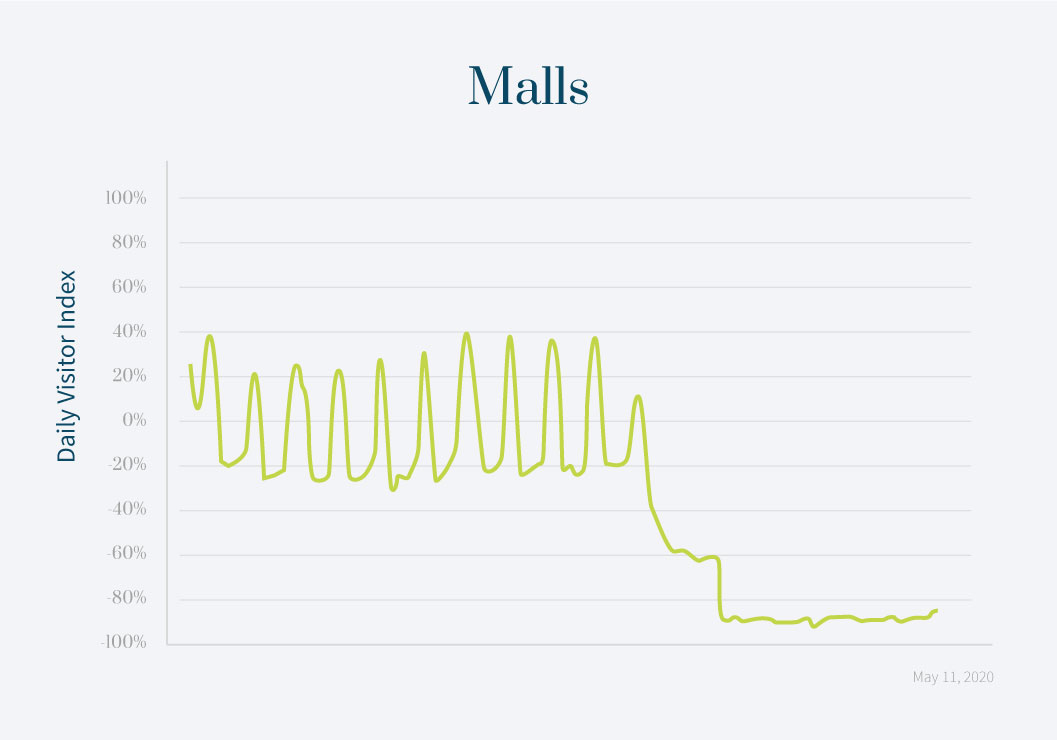

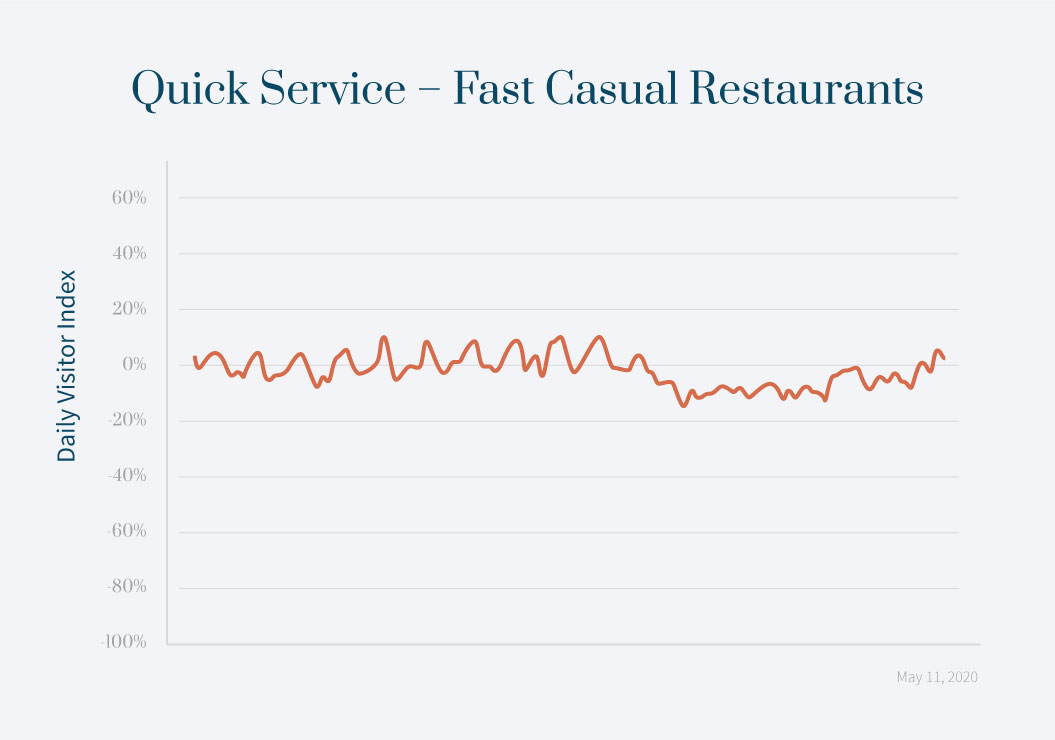

Out-of-Home Shopping

As the COVID curve flattens, consumers are becoming more comfortable leaving home and planning future vacations. US consumers are increasing Out-of-Home Shopping, which bodes well for the general economy.

Week over week, Zeta has seen a…

- 7% INCREASE in visits to Malls.

- 26% INCREASE in visits to Auto-Parts Stores

- 4% INCREASE in visits to Quick-Serve Restaurants.

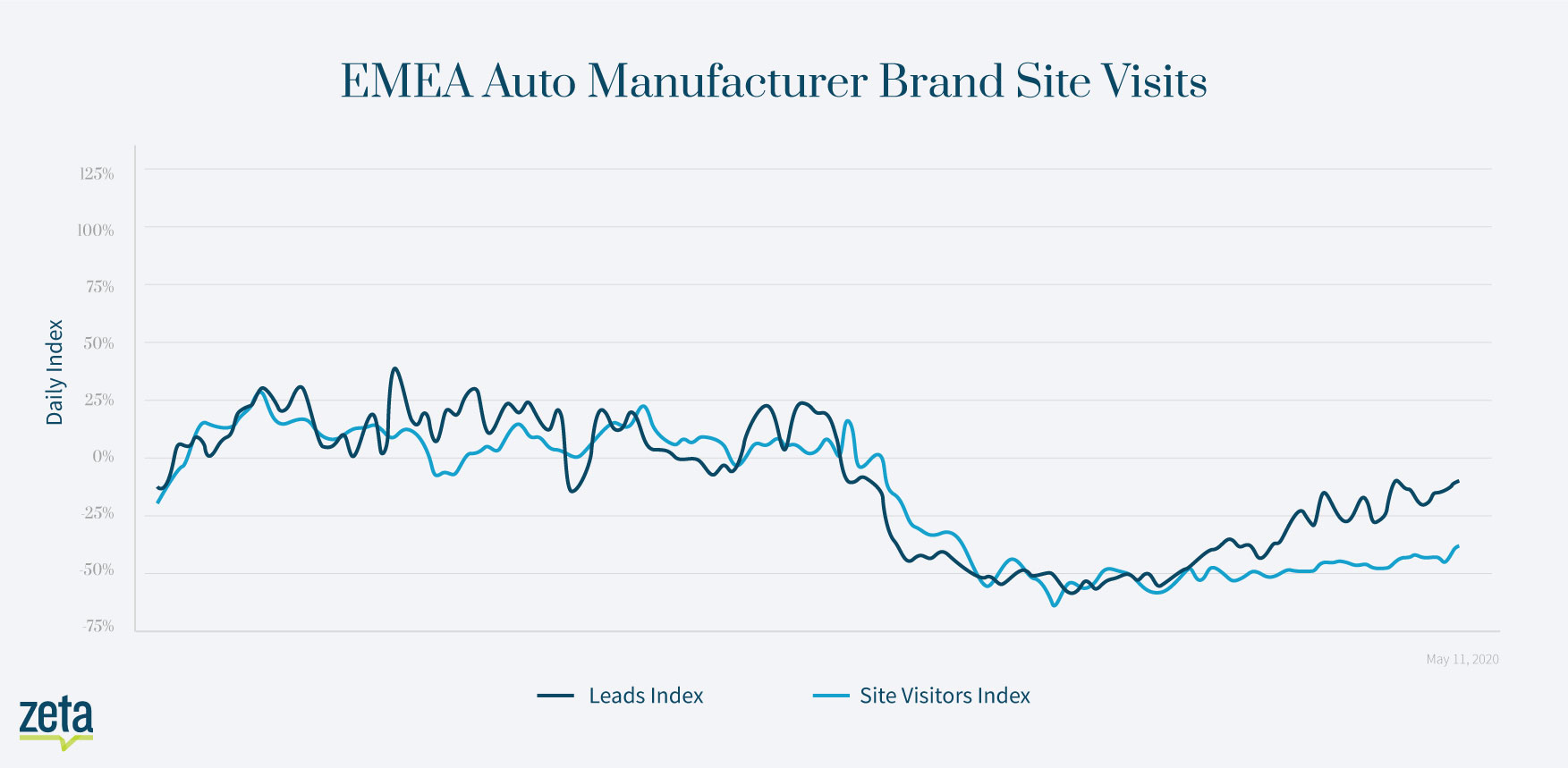

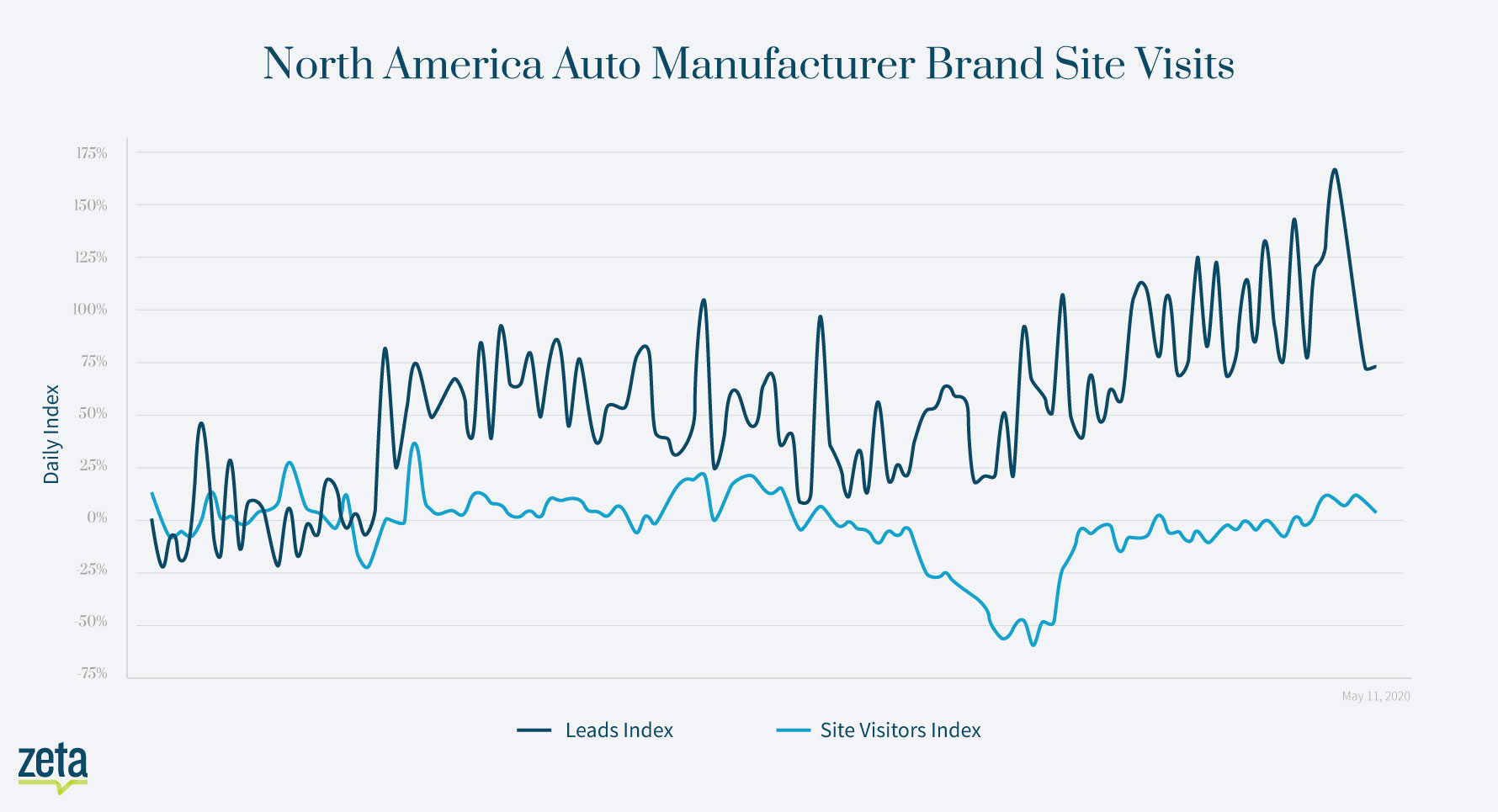

Automotive

Automotive websites continue to attract consumer attention, bringing much-needed leads to dealerships in both the North American and European markets (in addition to being another sign of strengthening consumer confidence).

While Europe lags behind the US year-to-date in terms of leads derived from website visits, they’re catching up, and this past week saw a higher growth rate than their American counterparts.

Week over week, Zeta has seen a…

- 11% INCREASE in site visitors to US auto-manufacturer websites.

- 10% INCREASE in leads from EMEA auto-manufacturer websites.

Hospitality

Consumer engagement with hospitality websites is increasing, which is a leading indicator of growing consumer confidence. The visits to luxury brand hotels is up 10% versus last week. Moreover, the time on site for both luxury and economy brands is up 10%.

This continues last week’s trends, which suggests consumers are resuming their planning for discretionary travel (e.g. summer vacation). However, given the concerns around airline travel, much of this increase in consumer interest in hospitality is focused on hotels and drive-to destinations.

Week over week, Zeta has seen a…

- 10% INCREASE in site visitors for both luxury hotel brands.

- 10% INCREASE in terms of time on site for both economy and luxury hotel brands.

Display

The glut of display inventory is giving marketers access to consumers in premium contexts at bargain prices. Right now, nearly every category is down by double digits.

However, one of the few categories to buck the “bargain trend” is auto part advertising, which saw a 12% increase in CPMs week over week. This surge in price is likely due to the increase in consumer interest in doing long postponed auto repairs.

Week over week, Zeta has seen a…

- 30% DECREASE in CPM for retail and consumer electronics categories.

- 12% INCREASE in CPM for auto parts categories.

- 5% DECREASE in video CPMs across all categories.

Zeta’s Big Takeaway

Despite the growth in unemployment, consumer confidence remains strong. Consumers are increasingly returning to out-of-home retail as many regions are beginning to lift quarantine restrictions.

Signals within the auto, travel, and hospitality sectors all point to the start of an economic recovery.

Marketers should do their best to get their brands top of mind RIGHT NOW so they’re well positioned as economic patterns move back towards pre-COVID-19 levels.

In the coming weeks, brands should:

- Capitalize on previously overlooked or underutilized marketing opportunities—channels like ConnectedTV or email.

- Produce increasing quantities of “future-focused” content that inspires consumers to spend money on big-ticket items.

- Think about their advertising, or rather, their approach to targeting—going forward it will be more important than ever to target individuals with precision.

Zeta hopes the following insights can help guide you to make wiser decisions over the weeks and months ahead. In the meantime, stay safe, stay healthy, and be well.

***The above statistics are generated from Zeta Global’s Disqus network, Personalization site visitation network and programmatic media buying.***