Articles | June 4, 2020 | 3 min read

Zeta Digital Trends Update – Week of June 1st, 2020

Zeta’s Digital Trends Update offers insights on things like media spend, site engagement, internet traffic, and more.

Consumers are resuming their normal commercial patterns as states ease back on social-distancing regulations. Strong consumer confidence is driving out-of-home shopping in a positive direction in every category except grocery stores. This is a sign that precautionary stockpiling of everyday goods (bread, milk, toilet paper, etc.) is over.

Interestingly, foot traffic to malls and brick-and-mortar retail is up week-over-week, with movie theaters making an impressive 14% jump.

Week over week, Zeta is seeing…

The automotive sector continues to remain competitive despite the COVID crisis. European auto manufacturers are seeing their best week all year in terms of leads. However, they still trail US manufacturer websites which are seeing almost double the volume of visitors and leads relative to January.

Week over week, Zeta is seeing…

Strong consumer confidence is evidenced by increasing traffic to hospitality websites. Visits to luxury-brand hotel sites are again up double digits. Time on site for luxury brands is also increasing. This signals increased interest in discretionary travel. However, economy hotel brands are flat week over week (but well above the lows seen in Q1).

Week over week, Zeta is seeing…

Unfortunately, inventory prices remain far below normal levels. However, this presents brands with an opportunity to capture consumer attention at a bargain price.

Week over week, Zeta is seeing…

Despite social unrest and a recession, Americans are optimistic about the future. More importantly, they are ready to resume the activities they enjoyed prior to COVID.

While CPMs remain much lower than normal, this may not last much longer. Especially as consumers get back to “business as usual” in the coming weeks. Some sectors can expect to see record consumer interest with soaring sales throughout the summer.

Digital Trends on the Up…

- Airtravel

- Retail

- Hospitality

Digital Trend FLAT or on the Decline…

- Video CPMs

- Display CPMs

Out-of-Home Shopping

Consumers are resuming their normal commercial patterns as states ease back on social-distancing regulations. Strong consumer confidence is driving out-of-home shopping in a positive direction in every category except grocery stores. This is a sign that precautionary stockpiling of everyday goods (bread, milk, toilet paper, etc.) is over.

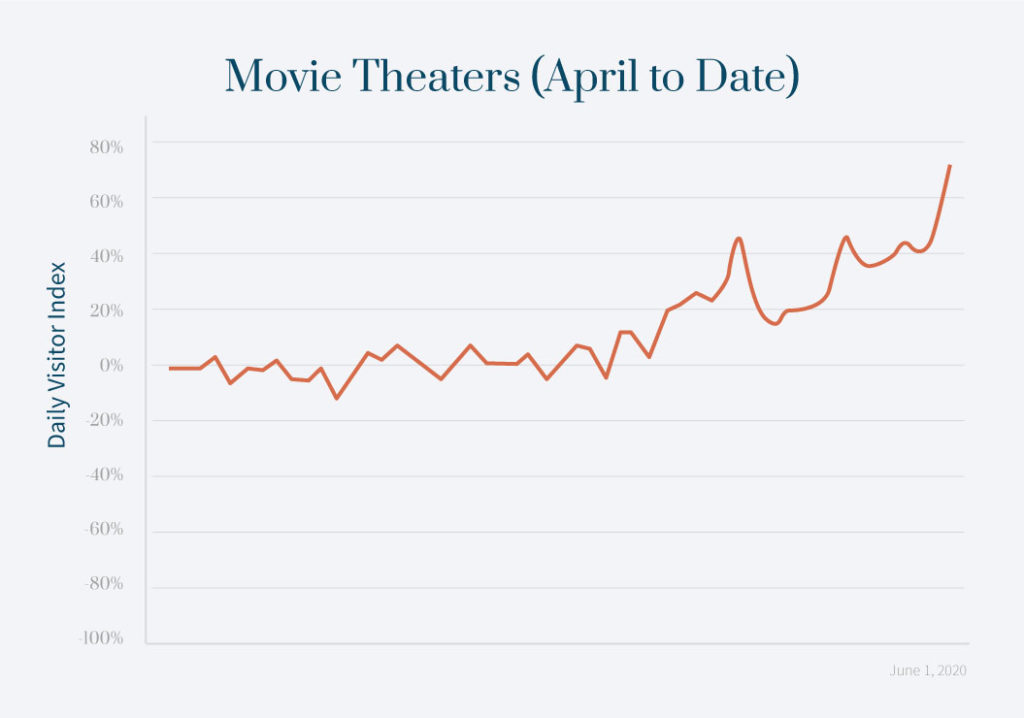

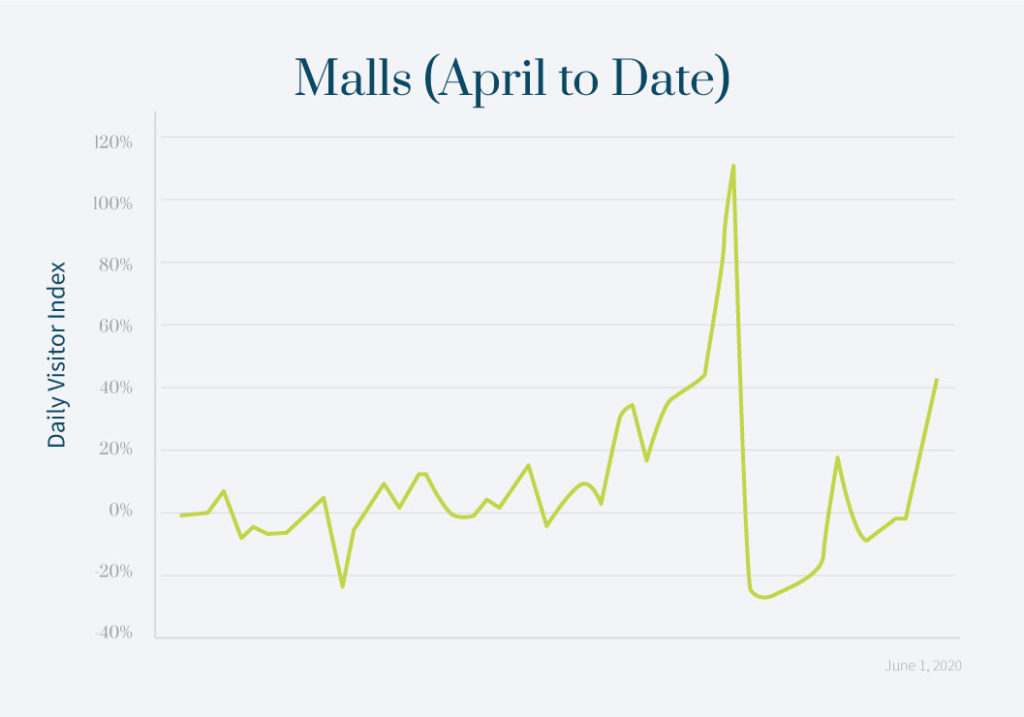

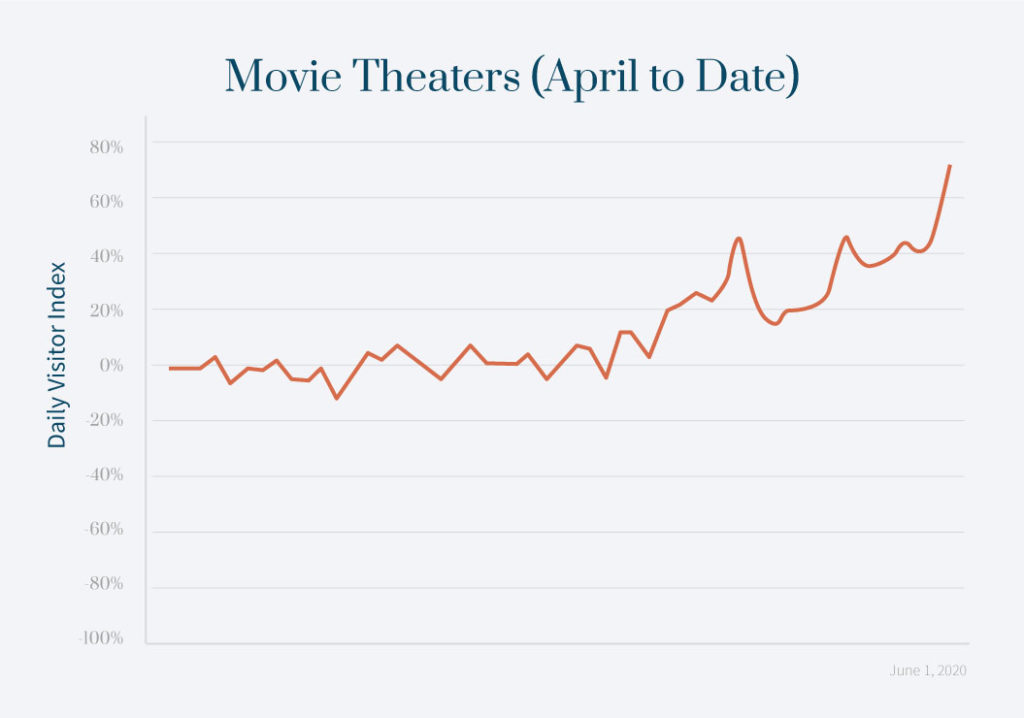

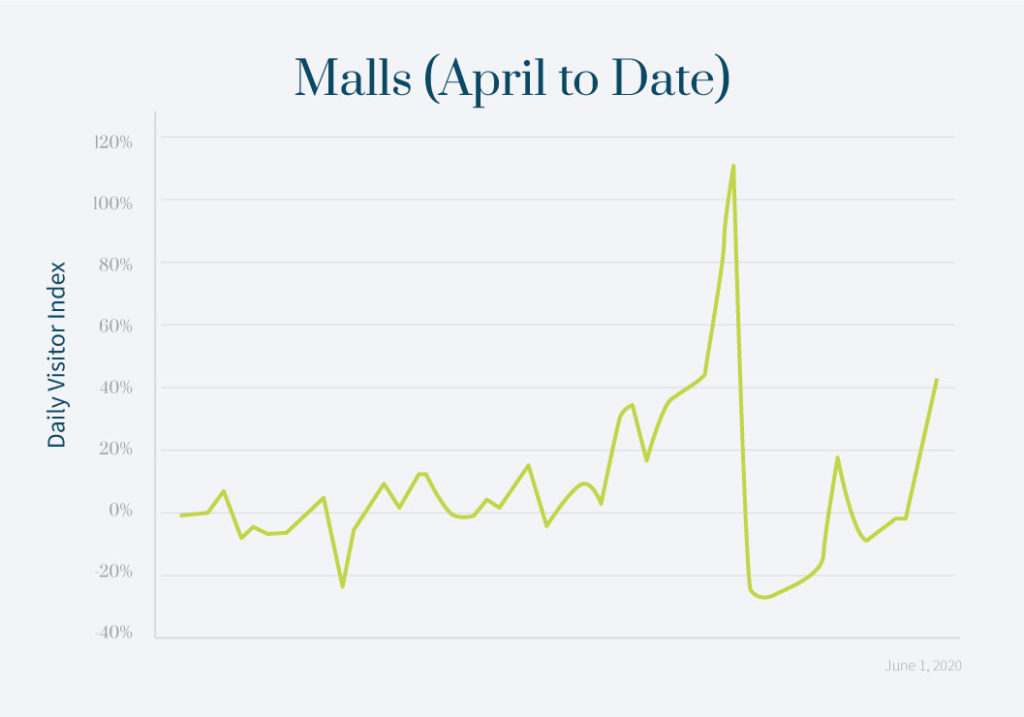

Interestingly, foot traffic to malls and brick-and-mortar retail is up week-over-week, with movie theaters making an impressive 14% jump.

Week over week, Zeta is seeing…

- 21% INCREASE in visits to Malls.

- 15% INCREASE in visits to Retail Stores.

- 11% INCREASE in visits to Gyms.

- 11% INCREASE in visits to Airports.

- 14% INCREASE in visits to Movie Theaters.

Automotive

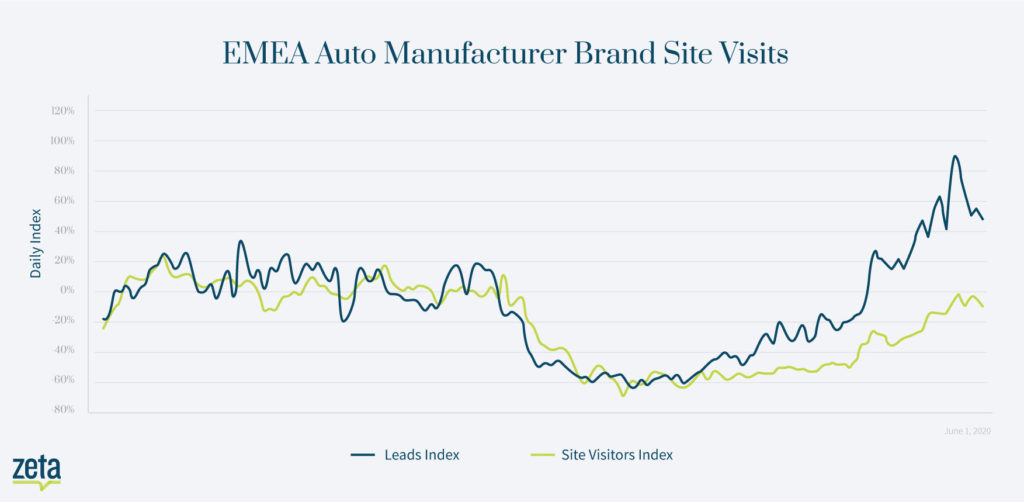

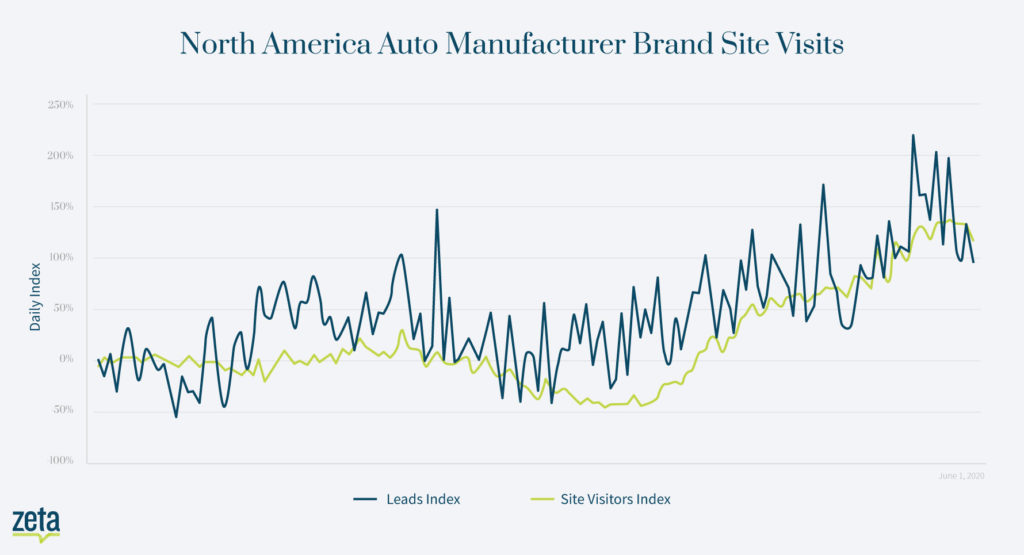

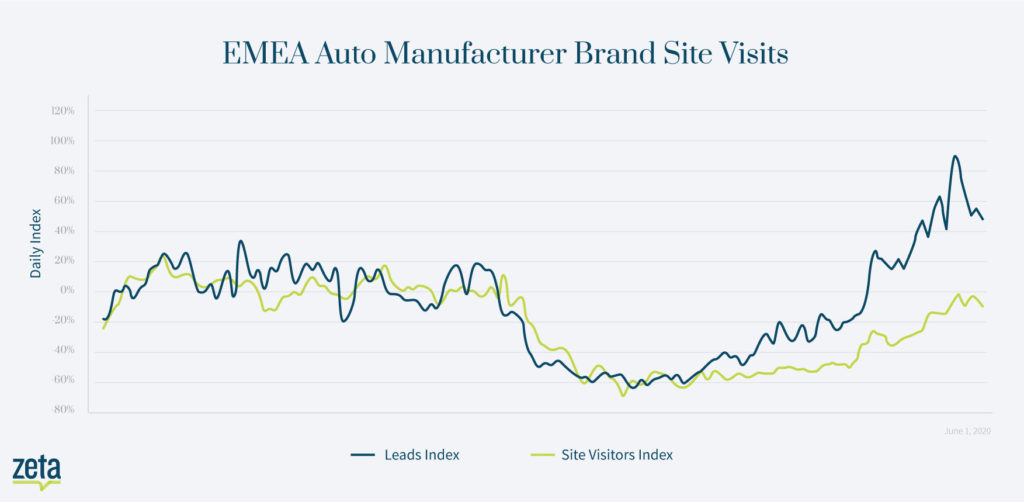

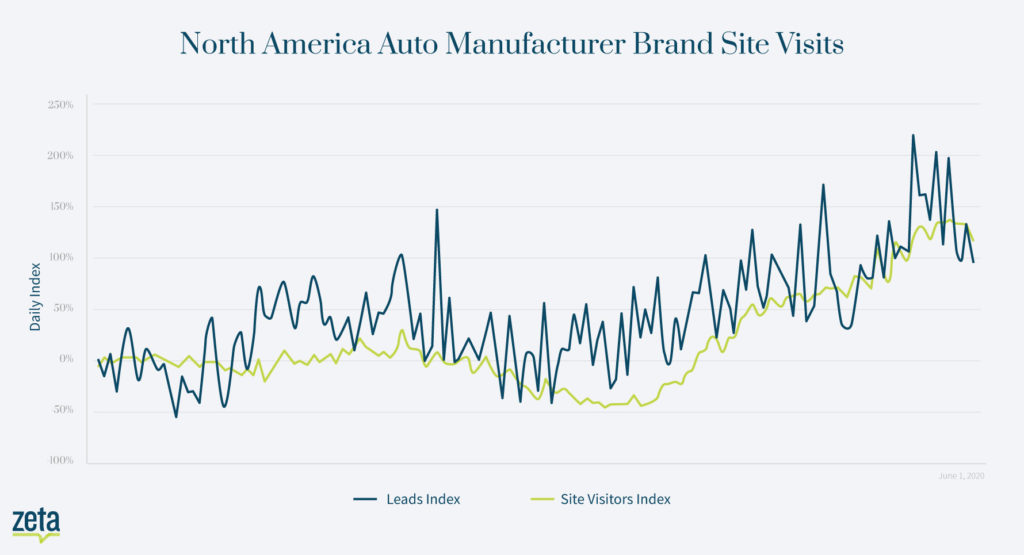

The automotive sector continues to remain competitive despite the COVID crisis. European auto manufacturers are seeing their best week all year in terms of leads. However, they still trail US manufacturer websites which are seeing almost double the volume of visitors and leads relative to January.

Week over week, Zeta is seeing…

- FLAT in site visitors and leads to US auto-manufacturer websites.

- But a 16% INCREASE in leads from EMEA auto-manufacturer websites.

Hospitality

Strong consumer confidence is evidenced by increasing traffic to hospitality websites. Visits to luxury-brand hotel sites are again up double digits. Time on site for luxury brands is also increasing. This signals increased interest in discretionary travel. However, economy hotel brands are flat week over week (but well above the lows seen in Q1).

Week over week, Zeta is seeing…

- 41% and 14% increases in site visitors and time spent on site respectively luxury hotel brands.

- FLAT in terms of time on site and site visitors for economy hotel brands.

Display

Unfortunately, inventory prices remain far below normal levels. However, this presents brands with an opportunity to capture consumer attention at a bargain price.

Week over week, Zeta is seeing…

- No change in CPM for display and video formats.

Zeta’s Big Takeaway

Despite social unrest and a recession, Americans are optimistic about the future. More importantly, they are ready to resume the activities they enjoyed prior to COVID.

While CPMs remain much lower than normal, this may not last much longer. Especially as consumers get back to “business as usual” in the coming weeks. Some sectors can expect to see record consumer interest with soaring sales throughout the summer.

Zeta hopes the following insights can help guide you to make wiser decisions over the weeks and months ahead. In the meantime, stay safe, stay healthy, and be well.

***The above statistics are generated from Zeta Global’s Disqus network, Personalization site visitation network and programmatic media buying.***