Articles | May 11, 2020 | 4 min read

Zeta Digital Trends – Week of May 4th, 2020

Digital Trends on the Up…

- Out-of-Home Shopping

- Automotive

- Hospitality

Digital Trends on the Decline…

- Sports

- Video CPMs

- Display CPMs

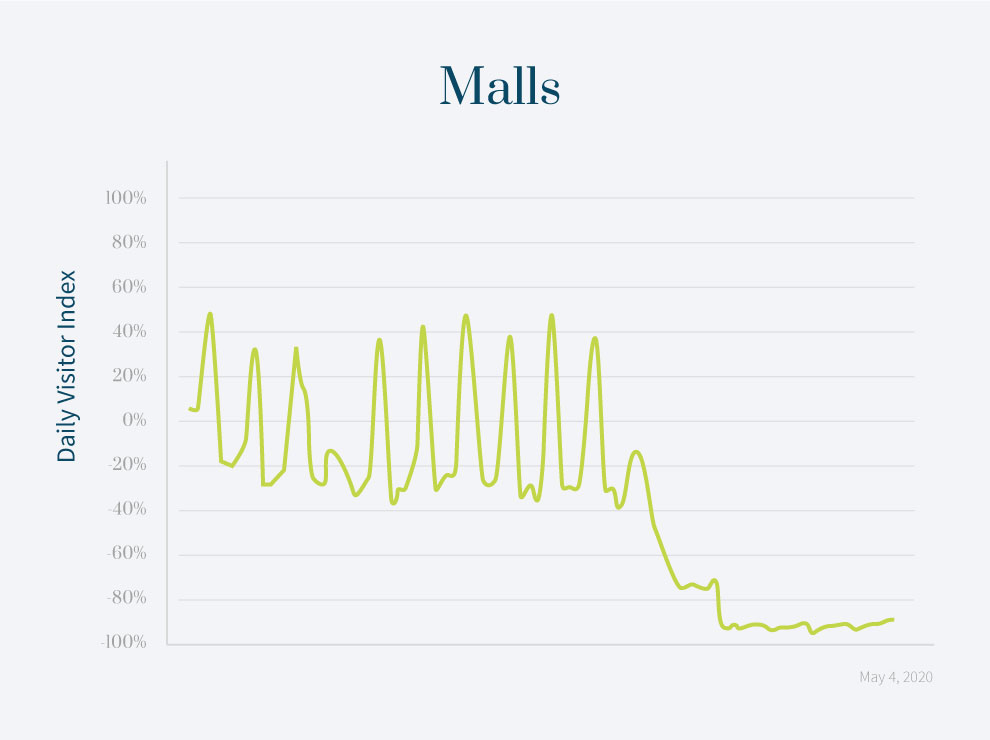

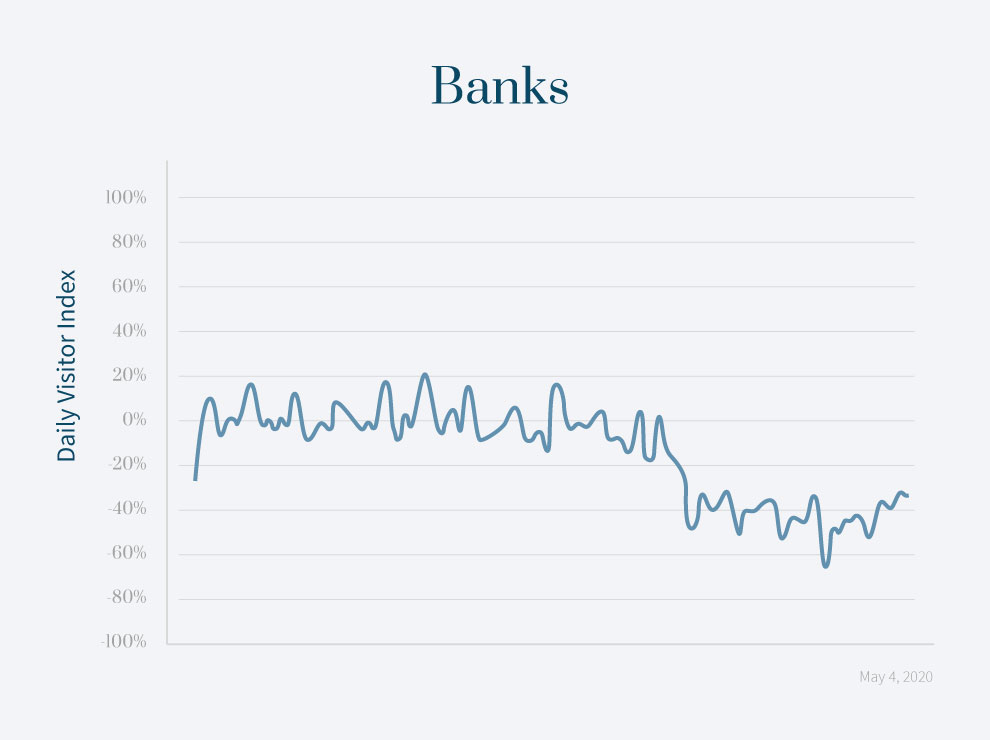

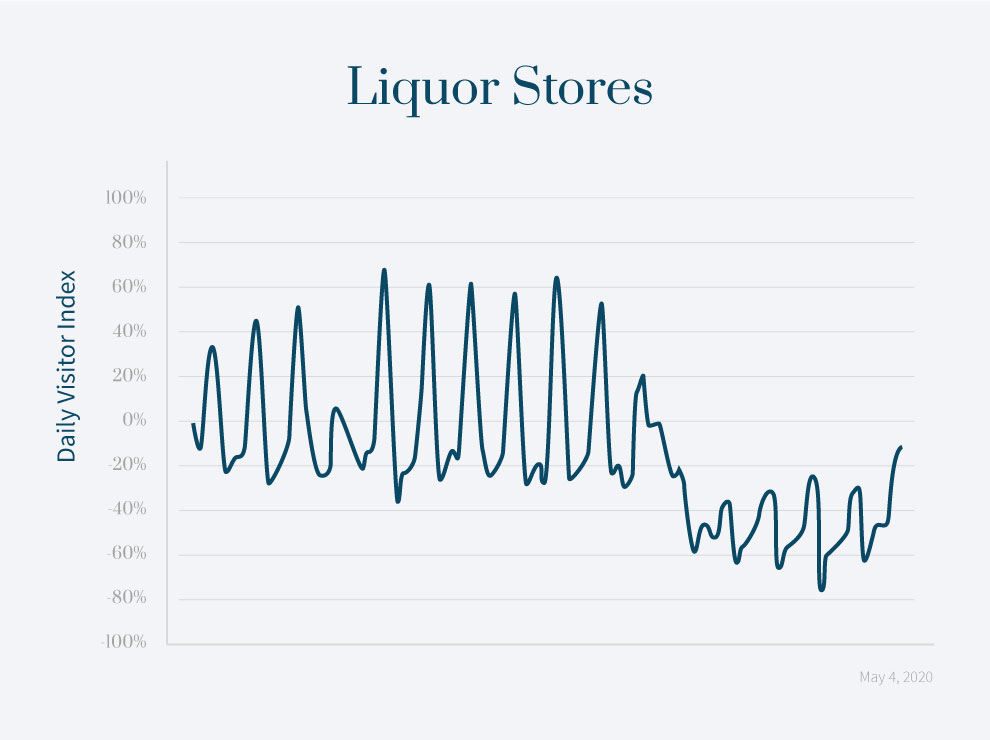

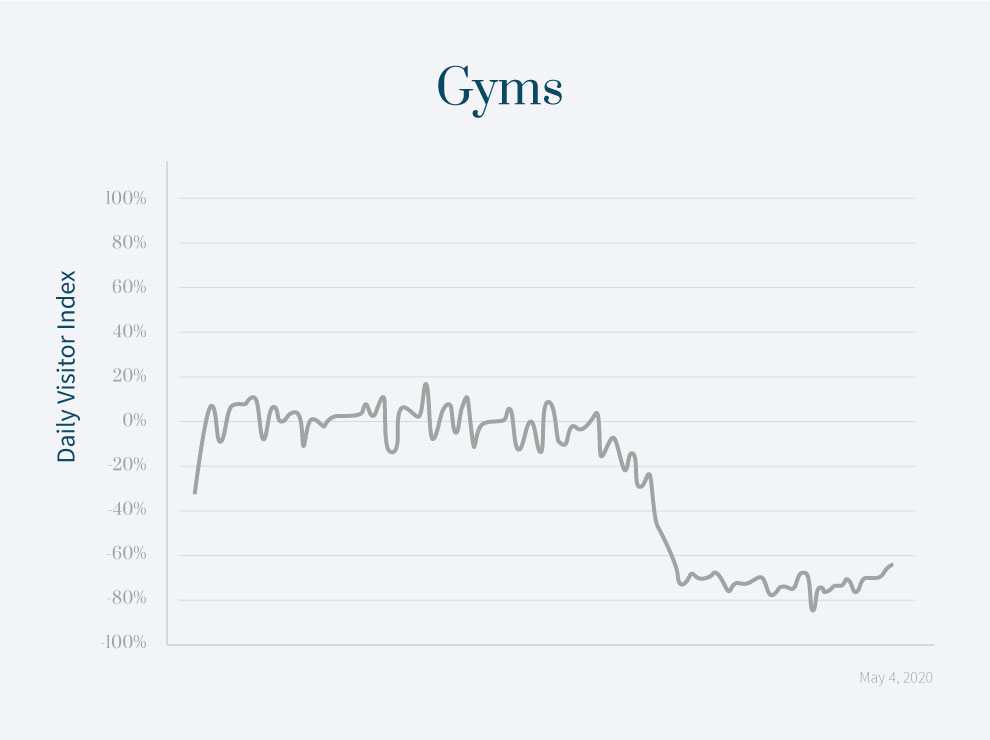

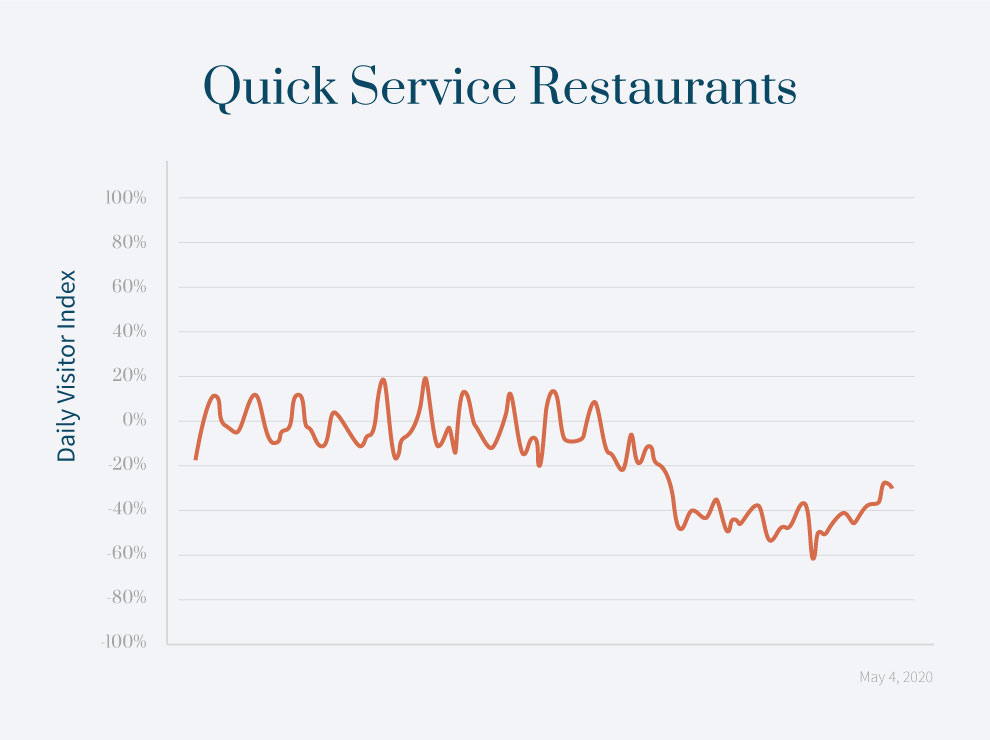

Out-of-Home Shopping

Many US states are lifting stay-at-home orders, while encouraging people to maintain physical distancing. As such, almost every category related to Out-of-Home Shopping increased by double-digits week over week.

Though far from pre-COVID levels, these large increases indicate consumer confidence, as well as consumer optimism, remain high—good signs for a rapid economic recovery.

Week over week, Zeta has seen a…

- 23% INCREASE in visits to Malls.

- 22% INCREASE in visits to Quick-Serve Restaurants.

- 22% INCREASE in visits to Liquor Stores.

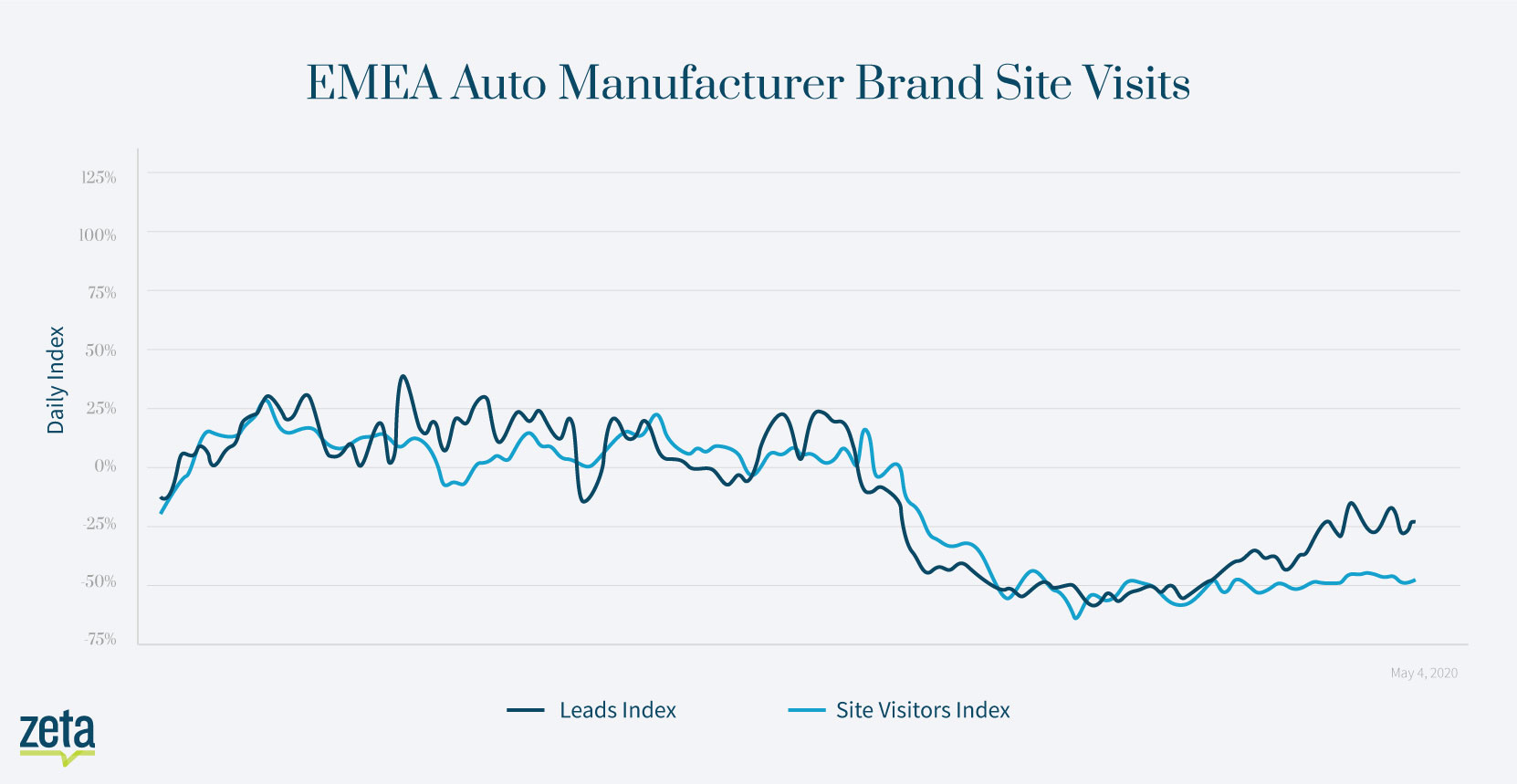

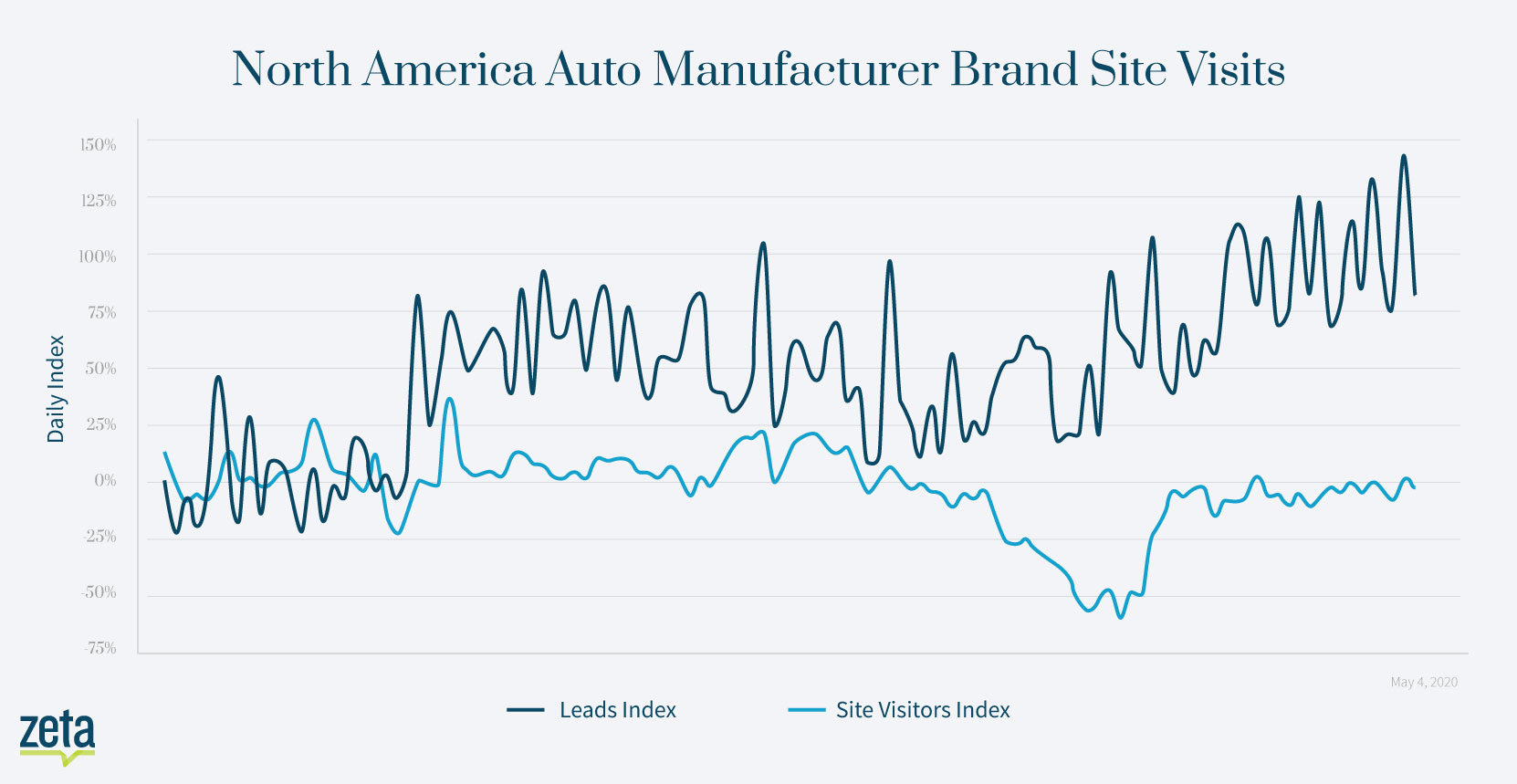

Automotive

While US automotive websites visits generated more leads for dealerships than any other week this year.

Europe still lags behind the US in terms of leads derived from website visits, but European automakers are seeing healthy growth from the continued investment in advertising that’s driving incremental consumer purchases.

Week over week, Zeta has seen a…

- 8% INCREASE in leads from US auto-manufacturer websites.

- 16% INCREASE in leads from EMEA auto-manufacturer websites.

Hospitality

Hospitality website traffic—a leading indicator of consumer confidence—is growing, which suggests travel-hungry consumers believe the global economy is on the cusp of opening up.

Continuing the digital trends from last week, time-on-site for economy brands has increased to the point where the numbers are back to where they were in January, a further indication that consumers are resuming their planning for discretionary travel (e.g. summer vacation).

Week over week, Zeta has seen a…

- 5% INCREASE in site visitors for both economy and luxury hotel brands.

- FLAT in terms of time on site for both economy and luxury hotel brands.

Sports

Sports entertainment is an interesting vertical to watch, especially as ability to create new sports content is understandably delayed. Last week we saw an increase in consumer interest due in large part to the NFL Draft, and the 1997-98 Chicago Bulls The Last Dance docuseries. This week we saw an almost identical decline. Since the docuseries is still being viewed, this suggests that the NFL draft was the overwhelming driver of the increase in interest among sports fans.

Week over week, Zeta has seen a…

7% DECREASE in content related to sports.

Display

The economics associated with digital publishing are driven by supply and demand. While consumer internet activity increased as a result of shelter in pace orders, marketers pulled back spending by approximately 33%, given the uncertainty about the economy. Thus, the CPMs for display advertising have remained flat, which signals we are at the bottom with upside ahead as many regions begin to lift their stay-at-home orders.

A few select categories have seen increased consumer spending and marketers are eager to get their brands top of mind.

Week over week, Zeta has seen a…

- 7% INCREASE in CPM for shipping.

- 18% INCREASE in CPM for furniture.

- 4% INCREASE in CPM for travel.

Video

Similar to display trends, the video CPMs are flat week-over-week.

Week over week, Zeta has seen a…

- 0% change in video CPMs for food service

- 0% change in video CPMs for auto parts stores

Zeta’s Big Digital Trends Takeaway

Despite record numbers of unemployment, consumer confidence remains strong. Consumers are going back outside and visiting businesses in states slowly lifting quarantine restrictions.

Signals within the travel and hospitality sectors indicate a rapid economic recovery is possible, especially if consumer spending in key industries (like automotive) continues its weekly growth.

In the coming weeks, brands should:

- Capitalize on previously overlooked or underutilized marketing opportunities—channels like ConnectedTV or email.

- Produce increasing quantities of “future-focused” content that inspires consumers to spend money on big-ticket items.

- Think about their advertising, or rather, their approach to targeting—going forward it will be more important than ever to target individuals with precision.

Zeta hopes the following insights can help guide you to make wiser decisions over the weeks and months ahead. In the meantime, stay safe, stay healthy, and be well.

***The above statistics are generated from Zeta Global’s Disqus network, Personalization site visitation network and programmatic media buying.***