Articles | November 17, 2020 | 3 min read

Last-Minute Marketing Trends for Black Friday and Cyber Monday

With the holidays almost here, marketers are busy finalizing campaign strategies and budgets to get the best results possible for their brands. To help you get the very most for your business heading into the all-important holiday season, here are some last-minute marketing trends for Black Friday and Cyber Monday that you need to know.

These last-minute trends are based on a unique combination of consumer location data and consumer signals pulled directly from the Zeta Data Cloud. The results provided are measured against a pre-Black-Friday baseline (all dates in October and November prior to the arrival of Black Friday) to make it easier to see how recent consumer behaviors will change in relation to the holidays.

Compared to the pre-Black-Friday baseline, consumer foot traffic for all industries (retail, travel, hospitality, dining, etc.) will be 5% higher on average.

This number may seem low, but it’s reflective of changing consumer behavior that goes beyond COVID-19. Put plainly, in-person Black Friday shopping simply isn’t what it used to be. Part of this is due to the proliferation of Cyber Monday, but part of it is also tied to the expansion of holiday sales beyond Black Friday in general (e.g. pre-Thanksgiving sales, Thanksgiving weekend sales, etc.) coupled with increased ease of online shopping.

Compared to the pre-Black-Friday baseline, consumer foot traffic for all industries (retail, travel, hospitality, dining, etc.) will be -2% lower on average.

While it may not surprise you that Black Friday outperforms Cyber Monday when it comes to consumer traffic at brick-and-mortars, the fact Cyber Monday doesn’t even beat the pre-Black-Friday baseline is unexpected.

Versus the pre-Black-Friday baseline, the week immediately following Cyber Monday will see a 17-point lift in foot traffic.

What this should tell you—more than anything else—is that holiday shopping no longer revolves around Black Friday for brick-and-mortar. That means it’s important for businesses with brick-and-mortar stores to continue running sales and in-store promotions up to and through Christmas day.

Across all industries, the one area where Black Friday is still extremely relevant is in the area of big-ticket purchases that regularly require financing.

From furniture retailers to auto dealers, if your business deals with pricey items where financing is common, you can expect a 15% surge in consumer traffic compared to the pre-Black-Friday baseline.

Forget Black Friday or Cyber Monday if you handle marketing for a department store or mall—this year your focus needs to be on the weekend.

Department stores and malls should expect to see an average increase in foot traffic of 49% over the pre-Black-Friday baseline of the Saturday and Sunday of Thanksgiving Weekend, compared to a 4% increase on Black Friday and a -3% decrease on Cyber Monday.

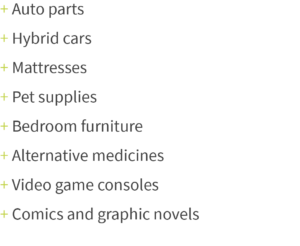

When it comes to shopping during the holiday season, there are some products (e.g. underwear, sleepwear, televisions, liquor, etc.) that consumers are always interested in.

While many of the traditional staples will once again be popular, consumers are showing unusual amounts of interest in less conventional product areas including:

If you found the above trends valuable and are in need of more last-minute marketing trends for Black Friday and Cyber Monday, please reach out to learn more about the Zeta Data Cloud…and if you need to know what to buy this Black Friday, click here.

These last-minute trends are based on a unique combination of consumer location data and consumer signals pulled directly from the Zeta Data Cloud. The results provided are measured against a pre-Black-Friday baseline (all dates in October and November prior to the arrival of Black Friday) to make it easier to see how recent consumer behaviors will change in relation to the holidays.

Compared to the pre-Black-Friday baseline, consumer foot traffic for all industries (retail, travel, hospitality, dining, etc.) will be 5% higher on average.

This number may seem low, but it’s reflective of changing consumer behavior that goes beyond COVID-19. Put plainly, in-person Black Friday shopping simply isn’t what it used to be. Part of this is due to the proliferation of Cyber Monday, but part of it is also tied to the expansion of holiday sales beyond Black Friday in general (e.g. pre-Thanksgiving sales, Thanksgiving weekend sales, etc.) coupled with increased ease of online shopping.

Compared to the pre-Black-Friday baseline, consumer foot traffic for all industries (retail, travel, hospitality, dining, etc.) will be -2% lower on average.

While it may not surprise you that Black Friday outperforms Cyber Monday when it comes to consumer traffic at brick-and-mortars, the fact Cyber Monday doesn’t even beat the pre-Black-Friday baseline is unexpected.

Versus the pre-Black-Friday baseline, the week immediately following Cyber Monday will see a 17-point lift in foot traffic.

What this should tell you—more than anything else—is that holiday shopping no longer revolves around Black Friday for brick-and-mortar. That means it’s important for businesses with brick-and-mortar stores to continue running sales and in-store promotions up to and through Christmas day.

Across all industries, the one area where Black Friday is still extremely relevant is in the area of big-ticket purchases that regularly require financing.

From furniture retailers to auto dealers, if your business deals with pricey items where financing is common, you can expect a 15% surge in consumer traffic compared to the pre-Black-Friday baseline.

Forget Black Friday or Cyber Monday if you handle marketing for a department store or mall—this year your focus needs to be on the weekend.

Department stores and malls should expect to see an average increase in foot traffic of 49% over the pre-Black-Friday baseline of the Saturday and Sunday of Thanksgiving Weekend, compared to a 4% increase on Black Friday and a -3% decrease on Cyber Monday.

When it comes to shopping during the holiday season, there are some products (e.g. underwear, sleepwear, televisions, liquor, etc.) that consumers are always interested in.

While many of the traditional staples will once again be popular, consumers are showing unusual amounts of interest in less conventional product areas including:

Need more last-minute marketing trends for Black Friday and Cyber Monday?

If you found the above trends valuable and are in need of more last-minute marketing trends for Black Friday and Cyber Monday, please reach out to learn more about the Zeta Data Cloud…and if you need to know what to buy this Black Friday, click here.